Kindred: Trusting Strangers In Your Home

The home-swapping network is a grand experiment in reciprocity

Welcome to the 11 new subscribers who joined us since the last Physicality. Please subscribe, post a review on your fav socials, or share with a friend!

Recommended listening (on repeat): Interlude - Ricercare - “On the Lot” by Nicholas Britell

Money corrupts. In fact,

“Money is the worst currency that ever grew among mankind. This sacks cities, this drives men from their homes, this teaches and corrupts the worthiest minds to turn base deeds.”

- Sophocles

While seemingly universal, this quote from the Greek playwright was poignant for this piece.

This edition is all about Kindred, the “trusted home swapping and exchange community”. It currently has 4500 members in 50 cities with a 25,000-person waitlist. Want to skip the line? Read on. (Yes, I’m a bonafide influencer with an access code now.)

Off the bat, I want to make it clear that Kindred is not another short-term rental play. Kindred uses a novel “give-to-get” model for swapping your primary residences. Cost per night? $25 (plus a cleaning fee). More than a swapping network, Kindred is the prodigal child of the sharing economy.

The “sharing economy” was the rage around the time of the Great Recession. An entire generation of companies was built around the premise that “owning” things was soooo last year. From ride-sharing to dog walking, we may not realize that we’re doing our share of this economy all the time. We also may miss that we’re not “sharing” at all. These marketplaces have become brokerages where the power is tilted toward the supply side of the platform. For most of them, sharing is not caring.

It took a fresh pair of eyes to understand the fundamental issues with the last generation of the “sharing” economy. Justine Palefsky, the co-founder of Kindred, sat me down to explain that there is a way to build a true, sharing marketplace based on trust between us. You see, Justine grew up in San Francisco. She promised her hippie parents (her words!) that even if she took a job at Bain & Company that she wouldn’t become a corporate dog. She would do good for the world. Let’s find out how she is sticking to that promise.

Today’s kindling:

Marketplaces: from peer-to-peer to peer-to-professional real quick

Kindred: the Sharing Economy’s Prodigal Child

A Business Around Establishing Trust

Growth: Slow is Smooth and Smooth is Fast

Trust IS the Moat

What took this so long?!

Getting more out of what we have

Marketplaces: from peer-to-peer to peer-to-professional real quick

Whether it is ridesharing (Uber), lending (Lending Club), reselling (Poshmark), or talent-sharing (TaskRabbit), the basic premise behind the “sharing economy” is that you can borrow/rent something when someone else isn’t using it. On the other side, you can make money off assets and skills when someone else needs it.

Many of these marketplaces were initially designed to be peer-to-peer. When Brian Chesky started Airbnb, he envisioned that you would be hosting complete strangers on your couch. Uber, although beginning as an on-demand black car service, pivoted to the sharing economy model by letting you drive strangers around in the Toyota Camry you already own. Consumers were to be the demand AND supply.

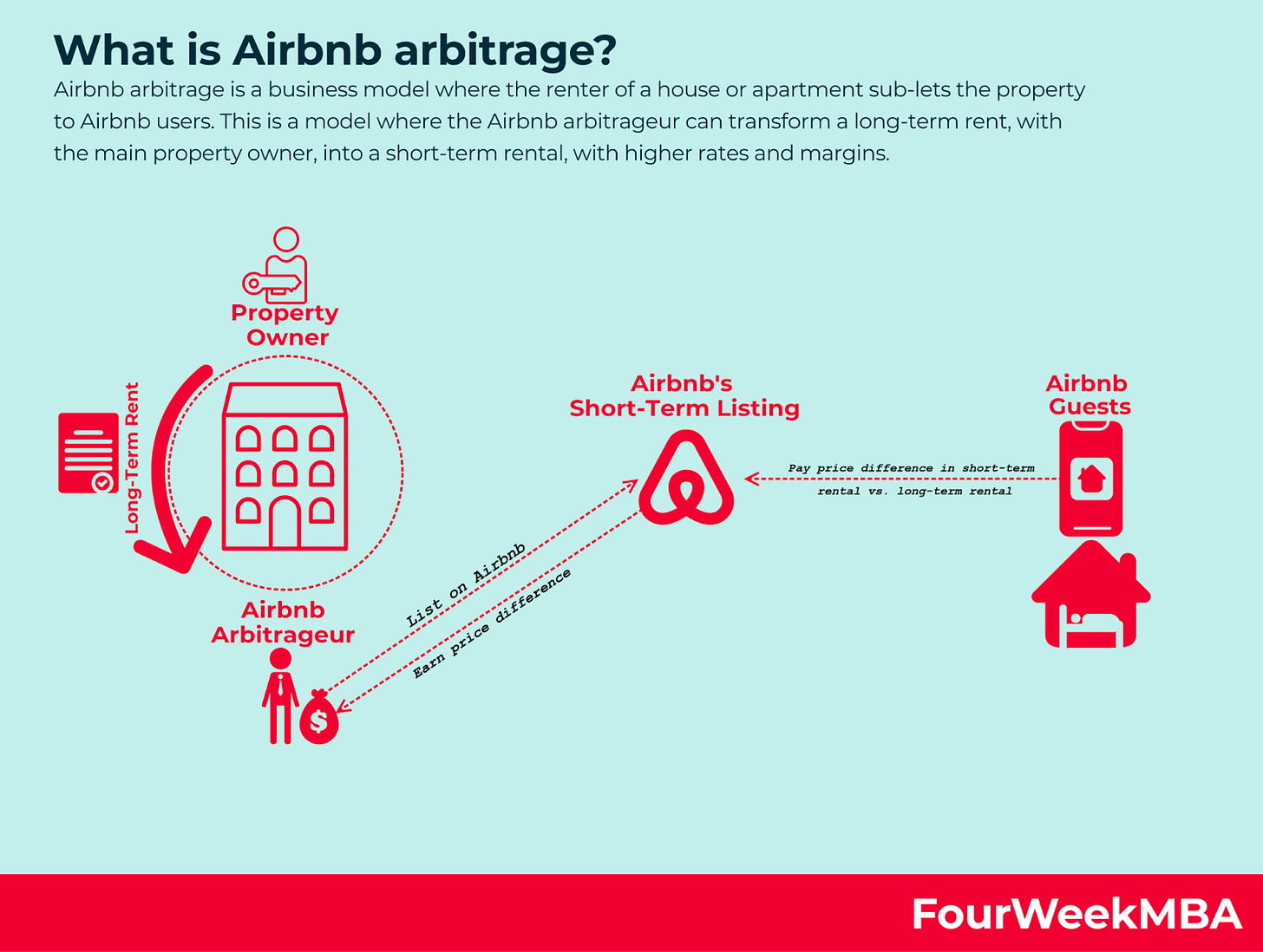

Money changes things. Once we as a species realized we could make money off of an unused bedroom, we asked ourselves, “Why not rent out my entire house when I’m on vacation” Hold on. “If I can make money passively, why not buy a second property that is rented out all the time?” And then. “If we can do that, why not have two?” And so on until we’ve gotten so sophisticated that you can Airbnb a property you don’t even own with an “Airbnb arbitrage”.

Over time, supply professionalized, gobbled up homes, hired staff, and created an entire enterprise on top of Airbnb’s. In response to these structural changes to the short-term rental market, an entire sub-industry of house cleaners, property managers, and amenity providers sprung up to service it.

According to Skift, as of 2021, corporate hosts make up 5% of all hosts on Airbnb but own nearly 30% of all listings. Other than being outdated, this figure likely understates the sheer magnitude of professional Airbnb hosts. This includes short-term rental (STR) players like ReAlpha who are spending $1.5B to turn 5000 houses into STRs. Another example is group-stay provider AvantStay which partnered with an investment firm to buy ~ $500 million worth of homes that they will manage.

Editor’s note: Before I move forward, let me preface by saying that I’m an Airbnb-stan. A fanboy, if you will. Don’t believe me? For fun, I wrote a 20-page history of their expansion into China that I never released. I also use these other short-term rental companies. They create new ways to stay that are unmet by hotels and open access to experiences previously gated to the upper echelons of income earners.

But have you ever heard of “externalities”? It’s when a business decision impacts others. The “Airbnb Effect” is the idea that in converting what could be long-term rentals or primary residences into short-term ones, we decrease the already limited housing supply. This has numerous externalities including upward price pressure on an already fragile housing market. For gaining choice and luxury, we have sacrificed the fabric of many neighborhoods.

It is undeniable that the rise of STRs has contributed to housing affordability. Just take Greenpoint and Williamsburg, neighborhoods I am struggling to find a reasonable apartment in right now. NYC’s Bureau of Budget found an 18.6% increase in rent due to Airbnb-induced pricing pressure. Keep in mind that this is from seven years ago and rents are now at an all-time high.

In response to all this, Airbnb recently launched “Rooms”, a new subcategory that returns to the first iteration of the business. Brian explains to Verge,

“We just really needed to get back to the roots of the company, back to our original founding ethos of sharing.“

While it is certainly welcome, it feels too late. Our cities have been sacked and men have been driven from their homes. In our Blank Street piece, we discussed how Starbucks is skating to where Blank Street already is. Airbnb is trying to do the same with Kindred.

Kindred, the Sharing Economy’s Prodigal Child

The Airbnb Effect played a heavy hand in Justine’s decision to start Kindred. By all accounts, Kindred is the first of its kind. And I don’t just mean as a house-swapping network. Kindred is a grand experiment in scaling reciprocity. It’s the purest form of the sharing economy yet.

Kindred is a members-only home exchange platform. How it works:

To join the marketplace, you first have to offer up your primary residence.

For each night someone stays at your place, you earn a night that you can then spend staying at someone else’s.

You can also do a direct house swap, brokered by Kindred.

Kindred sends a cleaning crew before AND after someone stays at your house.

It is a true “give-to-get” marketplace. Meaning, members get as much out of the platform as they give. By having to give up their own home to access someone else's, it prevents members from being leeches on the network. Due to this, Justine says that Kindred can become an “effective and liquid marketplace that is essentially cash-free”.

By being cash-free, there is no benefit in “professionalizing” the network. You can’t pay your mortgage by putting your house on Kindred, for example. With supply maintaining equality with demand, this marketplace should not go the same way as Airbnb.

Let me be clear as Joe Biden, there is no financial exchange between guest and host. Members earn, not pay for, the ability to use the network. But that doesn’t mean this is a charity. Kindred can become a massive business.

Kindred, for coordinating the stay, handling trust & safety, arranging cleaners, etc, takes up to a $25/night service fee. Guests also pay for cleaning, but Kindred doesn’t take a cut of that.

Those who want to stay in other people’s houses more often can purchase a Kindred Passport for $600/year. This allows them to book unlimited trips without paying a service fee. That means if you book more than ~20 nights with Kindred, it’s worth it.

With Kindred, guests and hosts are truly aligned. They are supply AND demand. No one has more power over the other. Now it’s a matter of seeing if Kindred can get enough people to trust one another.

A Business Around Establishing Trust

There is a psychological reality that many of us become absolute psychos when money is involved. There is something about “well, I paid for it” that turns us into monsters. Think about how you treated your last hotel room.

In contrast, most don’t act this way when they are staying at a friend’s house. You are more inclined to give their space the respect it deserves. You may even leave them a gift to say thanks. Everything Kindred does is to recreate this sort of interaction.

Uber and Airbnb relegated “trust” to its users via rankings and ratings. This makes sense when you are trying to grow as quickly as possible. However, at a certain point, these can be gamed and/or lose meaning. To win with the Kindred model, real trust must be established. That means going beyond what its predecessors did.

Kindred believes that trust is nurtured, not labeled. You can’t fast play it. As Justine said, “If you sacrifice trust for a near-term milestone, you are taking a local maximum.” To build and scale trust, Kindred has to balance between being a managed marketplace and a fully open platform like Craigslist. Kindred can step in as an intermediary IF something goes wrong. But they know that for a sticky marketplace to form, the community needs to genuinely trust one another. All steps along the Kindred process are to establish trust within its terrarium:

Cultural Onboarding: When accepted, you undergo a cultural onboarding to learn the network norms. By setting the tone about what’s expected, it pushes for a consistent experience for all members.

Brand Standards: Professional photographers are sent to your residence so each listing feels on par with the others. Also, Kindred ensures that each property is a primary residence lived in by a real human, not a shell corp.

Meet & Greet: Before booking a stay, you must submit a video intro. Hosts are always able to request a call with a prospective guest before accepting them into their home. This allows for a genuine connection between host and guest. On top of this, they are adding a social media aspect to the platform so members can share more about themselves in the hopes of creating connections not necessarily brokered by Kindred.

All this hard work certainly makes me feel more comfortable staying in someone else’s home while they stay in mine… way more than… this:

Growth: Slow is Smooth and Smooth is Fast

Even with a 25,000+ person waitlist, Kindred is intentional about its growth. To date, they have only allowed in 4500 members across 50 cities throughout the United States, Canada, and Mexico. They just began with their Europe expansion (sign up here). They follow a hub-and-spoke model. In this framework, they will establish a base in a core market (London) and reach out to spokes (Edinburg?).

This isn’t because Kindred is exclusionary. They need to load balance where members are. For this entire home swap premise to work, hosts need to live in places that guests want to travel to. If someone lives in Bumblefrack, OH, it will be hard for them to earn credits or do a direct swap.

Although growth has been methodical, Justine makes it clear they have “global ambitions” and are going after the biggest possible pie. While short-term rental players are all fighting over similar properties, Justine sees primary residences as the real winning market opportunity. According to Statista, there are 140M potential homes in the United States. Of that, 83M are owner-occupied and ~44M are renter-occupied. That means 90% of all housing stock is used as primary residences. This is good news for the house swapping network.

Beyond global ambitions, Justine thinks home swapping can be expanded by targeting specific use cases. For example, swapping for parents with toddlers. Given that one home has all the same things needed to raise a child as the other, it makes it easier for the parents to justify the trip. More importantly, parents will have an affinity and trust for one another.

Kindred’s success is predicated on the ability to scale this trust.

Trust IS the Moat

The craft approach Kindred is taking to growth will also dig their competitive moats. Strategy Daddy Hamilton Helmer, the author of 7 Powers, defines moats as “those barriers that protect your business’ margins from the erosive forces of competition.” We’ll map Kindred’s business to the summary inspired by Flo Crivello. I mapped them from strongest to weakest. You’ll notice the through line is TRUST.

Network Effects: The experience for your customers gets better as more customers join in

Network Effects are everything when it comes to Kindred's success. Each new member added to the network is a new location you can stay at. Additionally, the more people you meet in the network, the more familiarity and trust you have with it. While anyone could create a new house-swapping network, the stickiness comes down to the members trusting the network AND having enough variety to visit.

Switching Costs: The effort it would take to move to your competitor is high

The steps laid out before: cultural onboarding, brand standards, and meet & greets all double as a defense to competition. Having gone through all that work, you are both less likely to leave and more likely to book on Kindred. You know others have gone through the same steps so you’re more inclined to trust them.

Economies of Scale: If it is cheap to make another of the thing you already built, you can grow quickly

Kindred doesn’t own the real estate. We call this being “asset-light”. Their incremental cost to adding a new customer is mostly marketing and it should decrease over time as they become more well known.

As they reach geographic density, service costs also decrease. For example, it becomes incrementally cheaper to hire a cleaner for 30 homes in the same city versus 3. This translates to a lower cost for the customer in the future.

Counter-Positioning: Your business model is designed so incumbents have conflicting incentives to compete effectively

Kindred is going directly against short-term lodging providers like hotels and STRs. These parties own expensive real estate. They need to charge high enough prices to turn a profit. Given this reality, they simply can’t compete with Kindred on price. The average Airbnb is $200/night. Kindred’s $30/night service fee just can’t pencil for them.

Process Power: Your operations/processes are so kickass that your competitors can’t figure out how you’re doing it or can’t keep up

This systematic, craft approach to growth is crucial to maintain Kindred’s infrastructure. If Kindred opened the floodgates, it wouldn’t be able to keep up with its promises of trust and safety support or be able to vet needed services. Kindred is dealing with people’s homes on both sides of the exchange so excellent and consistent customer service is needed. This level of craft is hard to replicate. Any one mistake will likely cause a customer to churn.

Cornered Resource: A company gains access to something desirable and scarce

Kindred is finding a certain type of traveler and a certain type of host. Both are looking to be cost-conscious while also desiring a unique lodging experience. Every house swapped is one less available lodging on a short-term rental marketplace.

Brand: You know and trust the brand and therefore you won’t use their competitor

Kindred is looking to be the most trusted house-swapping network. I think they are off to a great start. It was the sheer amount of people asking me about Kindred that made me curious about them in the first place.

Trust me now?

What took this so long?!

This “give-to-get” model of home-sharing is… pure? Wholesome? Brutally simple? It’s so simple that I found myself wondering why this wasn’t done before. Justine outlined three reasons:

Benefitting from the Long-Term Trend of Short-Term Rentals

The concept of staying in a stranger’s home was ludicrous until Airbnb’s conditioning. Then, massive amounts of infrastructure were built to further legitimize the category. Armies of property managers, house cleaners, and photographers were born. This very infrastructure is what allows Kindred to operate professionally, leanly, and scale quickly. Because of these dynamics, Kindred can take the baton back to what the sharing economy was supposed to be. It’s quite ironic.

Work-Life is WeChanging

Our work/life is taking the single largest shift since the invention of the desk job. You don’t need me to tell you that, you’re likely living it. Maybe you’re reading this at Noon Portugal time, waiting for your team to wake up in New York. Perhaps you’re on a beach in Maui on a Zoom and you forgot to turn your video off. Regardless of the permutation, travel is mixing with work in unprecedented ways. We are traveling year-round and not just at peak times. This means that more homes will be vacant, more often. Kindred is tapping into this newfound lodging liquidity. This liquidity solves the “matching” problem that would have existed in previous iterations of this idea.

Money is Tight, Time is Right

Kindred came out of stealth in April 2022. You know what was not in stealth mode? High-interest rates. The market correction we are still in the midst of made people need to stretch the dollar. The $25 price point for lodging could not have come at a better time.

Getting More Out of What We Have

We have always wanted to get more out of our real estate. We played around with timeshares, turning restaurants into nightclubs and coffee shops into wine bars. But what about our primary residence? Airbnbs are no longer the only option.

To recap, here are the differences between Kindred and Airbnb:

Kindred cares tremendously about the second-order consequences of mass short-term rentals. They don’t want to be lumped into the same category. With Kindred, your home can continue to be used as your home while you’re away. You get the utility you want out of it without potentially contributing to the Airbnb Effect. For those who travel often, Kindred allows you to get more out of what you already have.

In a world where Kindred becomes the norm, there is a seamless transition between how we live and play. When you stay at a Kindred property, you are not renting anything, you are residing.

Interested in joining? Skip that 25,000-person line with my access code: SAFI

What’s next?

Like what you read? Please like and leave a comment. It really helps!

Consider subscribing or sharing this with someone that likes to travel.

A mention on socials always helps!

Sources

Justine Palefsky, Co-Founder of Kindred

https://livekindred.com/

Opendoor alums raise $15M for Kindred, a home-swapping network

Research: When Airbnb Listings in a City Increase, So Do Rent Prices, Harvard Business Review

That Vacation Home Listed on Airbnb Might Be Owned by Wall Street, WSJ

The "Airbnb Effect" On An Already High-Cost, Shrinking Housing Market

Do short-term rental platforms affect housing markets? Evidence from Airbnb in Barcelona

You write well, very interesting piece to read. Keep it up

Great piece, such an interesting business model