Aero: The Airline Built out of Thin Air

When they go low, this semi-private carrier goes high-ish / Get a REAL Job #1

Welcome to the 58 who have entered The Physicality since the last issue. If you aren’t subscribed, join the 263 others who care about the real world here:

Safi’s Note - Introducing Get a REAL Job (scroll to the next airplane if you want to start reading the actual piece)

I didn’t think it would happen. We have crossed the 250-subscriber mark and hit a record high of 3,650+ views in the last 30 days. These 250+ subs are made up of email addresses I never expected to earn. You are joined by partners at excellent venture capital funds, executives at the most recognizable real estate and financial institutions in the country, journalists whom I respect, entrepreneurs I can’t wait to write about, and employees at tech companies we all use. I am tremendously grateful to all of you. I especially want to thank those who have graciously shared my writing on social media. That has helped the most. Heck, it even got the Wawa CEO to read the last piece:

You’re a small yet influential crowd. With access to this powerful network, I would like to help others. The Physicality started in late May after I suddenly was out of work. So, it was amazing to learn that this platform helped a friend get an executive job at a company I may write about. I will be ending each issue with a new section called “Get a REAL Job” where I’ll post one senior-level, one mid-level, and one junior-level role. If I can make a warm intro, I’ll include that.

Now, off to today’s issue!

Aero: The Airline Built out of Thin Air

As Aubrey Drake Graham once said, “Truck to the plane to the truck. Truck to the hotel lobby. Me? I go through underground garages.”

And for the foreseeable future, I didn’t think I had a chance at relating. That was until I learned about the whole new world of semi-private flying. A new crop of young airlines are taking to the skies, offering an experience that rests somewhere between a PJ (private jet) and commercial first/business class.

Aero, founded in 2019, is one of these aviation upstarts. They fly custom 16-seater ERJ135s out of private terminals in desired locales like Aspen, Los Cabos, and Sun Valley. Once in a while, they fly between European hotspots like Mykonos and Ibiza. One-way ticket price? As low as $975. To be clear, these are scheduled flights that are shared with other customers – not a private charter. It’s a first-class cabin… but the whole plane.

This new airline aspires to grow 400% in 2023. As I began analyzing how they could achieve this, I realized that we usually talk about a company when their strategy is laid bare. In contrast, Aero seems very much mid-flight. It is only a few years old, has five planes, and keeps changing its routes. Let’s get to the bottom of that.

You better buckle up because this issue of The Physicality is different. I wanted to freefall into completely new territory. We will be educating ourselves about the airline industry and briefly touching on Aero’s competitors before we analyze Aero itself through the lens of the “strategy kernel”. And more puns per paragraph than any other piece.

There will be turbulence:

Why the Quality of Air Travel Nosedived

Semi-Private is Becoming Public

How Aero May Shoot for 400% Growth

Aero Is Ready To Take Off

Why the Quality of Air Travel Nosedived

We’ve all been on a plane. We’ve all been in airports. We know it can be a dumpster fire. Especially lately, as the industry recalibrates after the jarring blitzkrieg of the pandemic. But have you ever thought about why flying changed so drastically from the idyllic set pieces of old?

Why we went from this

To this?

Sexy deregulation.

Until the late 70s, airplane travel was swell. From the airport to touchdown, there was an emphasis on comfort, customer service, and details. This was due to the Civil Aeronautics Board. This powerful government agency heavily controlled most aspects of the flying experience. They had a vice grip on which routes airlines could take, partnerships between carriers, M&A, meals, and most importantly: ticket pricing. While quality was consistently high, so were prices.

In 1978, the Airline Deregulation Act was passed, shifting crucial business decisions from Uncle Sam to private airlines. This was compounded by the removal of the Civil Aeronautics Board entirely soon after. This marked the end of the “Golden Era” of travel. Everything changed. The two shifts worth highlighting:

Prices are Lower but so is Quality

Overnight, the entire industry MOVED. Prices dropped. Routes were added. Massive consolidation occurred. Flight volume soared. Without red tape, carriers began lowering prices. With price decreases, airlines prioritized accommodating volume over experience.

Then came the LCCs. Low cost-carriers. Spirit. Southwest. JetBlue. By the 2000s, these LCCs took what was happening to the extreme. They cut to the bone of what it meant to fly. They stripped back service, comfort, and amenities to go as low as possible on price.

It was becoming apparent that catering to the low end of the market, cutting prices to increase ticket volume, was the only viable growth strategy. The major airlines had no choice but to follow suit. There is a graveyard of the carriers that couldn’t or wouldn’t get in line.

Between deregulation and the emergence of LCCs, the U.S. skies got crowded.

Tickets, when adjusted for inflation, fell from an average of $648 in 1990 to $420 (blaze it) in 2019.

Planes went from being 54% full in 1975 to 85% full in 2019.

In 1975, there were 209 million flights. By 2019, that number ballooned to 930 million. In just 40ish years, the U.S. market grew by 345%.

Flying Takes… Longer?!

Deregulation-induced consolidation jammed the majority of travel into major hubs like JFK, PHL, LAX etc. The carriers that survived wanted more customers on their bigger planes. And those big planes could only land and take off at hub-sized runways. According to a NASA study, as of 2021, 30 airports account for 70% of all domestic U.S. travel.

However, there are 5000 airports that are zoned for public use. This massive consolidation lowered costs for us, yes, but it also reduced connectivity between places. In the last 20 years, we have fewer and fewer options for non-stop connections than before. In many cases, travel takes more time than it should. Airline startup SurfAir stated that the 120-mile flight from LA to San Diego could be 1.5 hours using smaller airports but takes 3.5 hours with a traditional carrier.

The major airlines abandoned their smaller fleets and smaller runways. This vast underutilization of regional airports is silly because according to McKinsey, 90% of the U.S. population lives within 30 minutes of such an airport. This is an opportunity for something new.

Semi-Private is Becoming Public

Commercial Business / First Class is nice af. Leg room. Complimentary beverages. Being treated like a human being. The good life. But Uma Subramanian, the Founder and CEO of Aero, saw a gap. While things are good once you’re on the plane, everything before that is not so great. Lines to check in your bag. Lines for security. Flight delays and cancellations. Inconsistent customer service quality. You’re paying $pricesbutnotalwaysgettinga$ experience the whole way through. As Uma aptly put it, “Your air travel experience is something to be suffered through.”

You can get around this by chartering a PJ but this $ experience is obviously paywalled to the 0.01%. If you’re chartering a jet, you’re likely the CEO of Waystar Royco. A huge draw of private travel is the pure speed from arrival to take off. You head to a private hangar or you’re driving right up to the runway. Your bags are on the plane before you are. You’re flying in minutes, not hours.

The semi-private airline industry was born by asking, “What if we can get the best of both worlds?… What if we can provide a broader group of customers with that PJ experience for a fraction of the cost?”

You can achieve this by fractionalizing the cost basis of a chartered plane. Instead of one party paying $20,000, a collection of customers are paying for a seat on a shared private plane. In doing so, it opens the market for this relatively un-unused plane class to a premium (yet not ultra-premium) customer.

This industry is brand new. In the last decade or so, a handful of contenders have emerged with different models on how to fly semi-private. Some do private memberships. Others do crowdsourced flights. Many do a combination. Here are some of Aero’s direct competitors, those that provide semi-private scheduled flights. It’s a crowded air space!

How Aero May Shoot for 400% Growth

Between the fact that semi-private travel is still not well known and that the air space is already somewhat crowded, 400% growth in a year is no small feat! Let’s explore how the company is positioning itself amongst its competitors to achieve this goal. To do this, we’ll use the lens of the “strategy kernel” as I Interpreted it from Packy McCormick’s In Defense of Strategy.

He crisply defines it as a mid-flight ginger ale:

“A high-level plan to achieve one or more goals [grow 400%] under conditions of uncertainty, designed through recognizing the challenge (diagnosis), setting a direction to overcome it (guiding policy), and detailing steps to implement the policy (coherent actions).”

The scene is set for us to cosplay a first-year McKinsey consultant. As a primer, here are the components of the strategy kernel, with the key actions of how to create it for another business:

Diagnosis: recognize the challenge

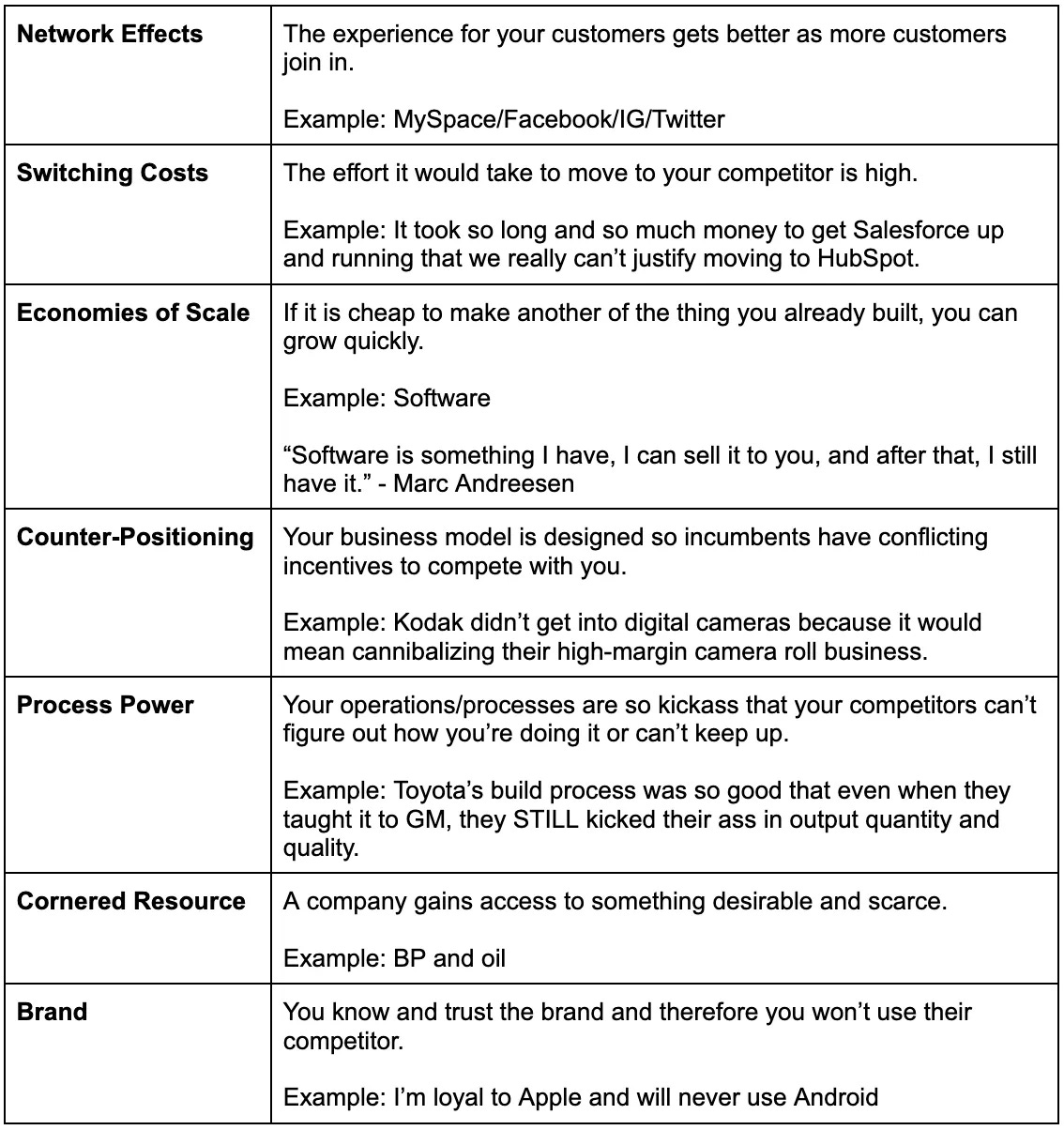

Aero identified the unmet customer need as a flying experience between commercial first class and a private jet. The next was to determine which moats they would like to potentially dig to close that gap. A moat is one or a combination of the 7 Powers below.

There are only a few potential moats a semi-private airline could use. I took a rough stab at what could be feasible moats.

Network Effects? No. There is no clear benefit to Customer A if Customer B also flies the same carrier.

Economies of Scale? No. It doesn’t become cheaper to buy or maintain a plane just because more people are using it. It costs the same whether one person is on it as it does with a full flight.

Cornered Resource? Maybe. I guess you could buy airports with shorter routes to desired destinations but that does not prevent your competitor from flying there eventually. It’s also a massive fixed cost for a startup.

Counter-positioning?

Yes - against major airlines because the semi-privates leverage small planes and airports that the big airlines would need to extend themselves to get back into. If they were interested in doing that, they wouldn’t have left in the first place.

No - against other semi-private carriers. All of the companies in the space are basically selling a version of the same dream.

Switching costs? Maybe. If an airline implements a loyalty program, that may cause me to prefer them over others. However, such a program doesn’t prevent me from choosing another airline.

Process power? Yes. If a semi-private airline is able to deliver on something like lowering the average speed to take off or outstanding customer service.

Brand? Yes. Awareness and loyalty of a certain semi-private carrier could be crucial in the early days as the entire industry gets off the ground.

While neither process power nor brand is usually strong enough moats on their own, a combination of the two could make for a solid strategic foundation.

Guiding Policy

Aero determined that to meet that unmet need, their guiding policy is to provide 80% of the private experience for 20% of the cost. This would require analyzing the entire PJ experience and determining which aspects of it could be done cheaper, balanced with maintaining a high enough quality.

Coherent Actions

Below are the steps Aero seems to be taking to execute its guiding policy. Almost all of their strategic decisions are in line with one of two moats: brand or process power. This smells like coherent actions to me.

Moat #1: Brand

The Planes

The bulk of Aero’s fleet consists of four, 16-person ERJ135s. Its attention to detail is reminiscent of an Apple product. All-black inside and out. The staircase onto the plane is painted in the same pattern as the logo. The seats are hand-stitched Italian leather. Suede side walls. Mood lighting. Window and aisle access at every seat. This emphasis on a distinct “Aero feel” is deliberate. While it may not fly any better than a competitor’s plane, Aero wants you to know that when you’re flying on an Aero plane, you’re flying high.

Personalized Experience

One of the major ways Aero is providing 80% of the private experience is through its attention to each passenger. Aero emphasizes hyper-personalization. They want each flier to feel as special as Tom Wamsgans would in Season 5 of Succession.

Aero:

Knows each customer by name and allegedly does light research on them

Ensures they have stocked your drink and snack preferences

Has a concierge team that can book you a driver and get you Aero rates in their hotel network, and reserve tables at the best restaurants

Arms each concierge team with a budget to splurge on customers. An example I came across was that when one customer mentioned she was going for a birthday, the team had fancy cupcakes waiting for her on the other end.

This is of course in addition to the expected fanfare of champagne waiting for you, your bags being taken care of, and locally curated snacks like juices from Erewhon when you’re in LA.

Moat #2: Process Power

Aero’s travel philosophy is “flying short distances, from private terminals to storied places that are harder to reach.” This alone reveals its strategic focus. They currently fly to five destinations: Dallas, Aspen, LA, Sun Valley, and Los Cabos. What’s notable is that their routes seem to change depending on customer demand. Aero has quickly spun up routes based on sufficient customer requests. Last summer, they ran a London to Malaga flight for a few weekends. Stateside, an SF to Sun Valley route was also temporarily part of the roster.

At the same time, they are known to par back flight plans. Aero recently suspended its Europe service which included flights between London, Nice, Geneva, and Sion. In an interview with Private Jet Card, Uma said, “We have decided to focus our resources in the U.S. market by expanding our offerings with the addition of Dallas and by doubling down on the Los Angeles market.”

As opposed to the major carrier that balances out the risk across hundreds of different routes, Aero has to prioritize a few. When you have a limited fleet, you need to go where the customers are going to pay you the most and pay you often. Their U.S. flights may have seen more volume and/or have been more profitable than their European counterparts.

Aero needs to be on the few routes that matter, and for the high-end traveler, those change. Its ability to spin up and spin down routes quickly is certainly an advantage. To be able to turn a logistically complex procedure into a lean one shows its process power.

Aero Is Ready To Take Off

While I give Aero a lot of credit here, their flight path is still uncertain. Aero is starting by primarily digging two moats: brand and process power. However, this may not be enough to hit their growth goals. In fact, as Packy writes in the before-mentioned piece,

“No matter which industry you’re entering, if you get to this point in the diagnosis and the best potential moat you can come up with is brand or process power, you might be in trouble. Both take a very long time to develop, if they do at all, and when they do, it’s often through some emergent magic.”

While the combination of the two could etch out a lead over others, they are still competing in an emerging yet still largely unknown market against interesting competitors. To reach Mach 5, they may need to layer in other moats or scrap their original plan and try new ones.

Frankly, the market is large enough that more than one semi-private airline could win. I personally can’t wait for The Physicality to take off so I can catch an Aero flight and some Aero feelings.

Thanks for reading! Thank you to Kaley and Julianna for editing.

Keep it real,

Safi

🧳 Get a REAL Job #1

If you’re a job seeker, email me with a short blurb about you (3-5 sentences) and links to relevant socials.

If you’re a job poster, email me with any details and we will discuss.

Senior Role/Investing: VC Fund needs a Real Estate Partner that has done a lot of deals

Jonathan Wasserstrum has been in PropTech before the word came out. He founded a company called The Squarefoot which he led until last year. At the same time as all this, he was a prolific angel investor. Now, he invests full-time with his fund Unwritten Ventures. There isn’t much about his fund online so take my word that he’s invested in some stellar companies (I saw his Airtable). He is looking for a real estate leader to work with him on the next Unwritten strategy. Please be a senior, partner-level contributor who knows their stuff.

JD here. Email to apply inside. Can try to warm intro.

Mid-Career Role/Operating: a16z backed Homeswap Network Needs Product Leadership

Everyone knows I love Kindred and would be putting up my apartment if my landlord let me. They are looking for a high accountability Staff Product Manager who can “lead the product development lifecycle, from strategic ideation to successful launch”. Sounds exciting. If I knew what a product manager did, I would apply myself. The team is the right mix of killer and kind.

JD here. Application inside. Can try to warm intro.

Junior Role/Investing: PropTech VC looking for an analyst

MetaProp, the fund I used to work for, is hiring an analyst. This is a rare one. I can’t remember the last time MetaProp hired one of these! Great opportunity if you’re passionate about the built world and want hands-on deal experience.

JD here. Apply link inside. Can try to warm intro.

What’s next?

Like what you read? Please like and leave a comment. It really helps!

Share this with someone that loves traveling or needs a job.

If you’re a company that is interested in a sponsored deep dive, drop me an email.

Sources:

Aero raises $65M for its semi-private airline, TechCrunch

The Aero experience: What it's like flying on a semiprivate jet for under $1,000

FLYING HIGH, A luxury airline startup finds cruising altitude

An Economic Analysis of the Low-Cost Airline Industry, Investopedia

Airline Deregulation: When Everything Changed

Unleashing Innovation: The Deregulation of Air Cargo Transportation