Welcome to the 69 (yes, I know haha) new subscribers who joined us since the last Physicality. Please subscribe, post a review on your fav socials, or share with a friend!

I really enjoyed working with the Kindred team on the last piece. In less than a week, 150 of you used access code SAFI to apply. This is incredible! You all rock. If you’re interested in me doing a deep dive into your company, email me.

Recommended listening: Quantum Mechanics - Ludwig Goransson

What do you find sacred? Is it represented by one of these?

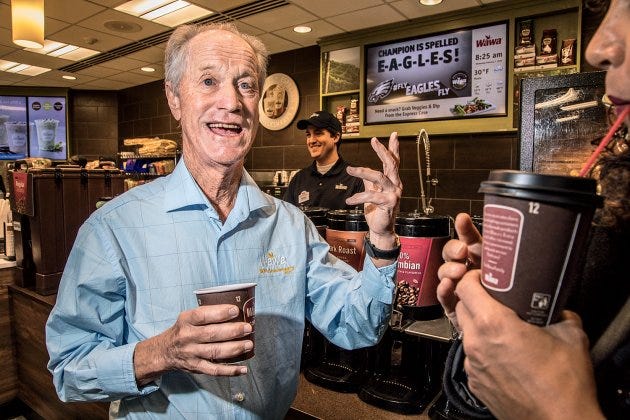

For those in PA, NJ, DE, MD, VA, FL, and Washington D.C. sacred may be represented by this:

Wawa, the 24th largest private company in America, is “America’s Favorite Convenience Store” and it brings in America-sized cash. In 2022, it raked in $15B in revenue. That’s more than McKinsey (29th), Bloomberg (32nd), and Twitter (104th).

Wawa is there for you at every stage of your life. This is a holy ground for everyone from 8-year-old Safi treating himself to a Honey Turkey hoagie after school to 17-year-old Safi spilling a cookies & cream milkshake on his 10 pm rendezvous to 28-year-old Safi slamming a 24 oz. half French vanilla half blueberry coffee that cost like $1.39 while he struggles to finish this masterpiece.

After pandering to my California readers with the Erewhon deep dive, it only felt proper to go back to my East Coast roots. In many ways, Wawa is the equal yet opposite of the luxury grocer. Let’s compare:

Erewhon has nine locations. Wawa has over 1000.

Erewhon is about the highest price. Wawa is about the lowest.

Erewhon is about keeping people around. Wawa is about getting people on their way.

There are similarities as well. Both care about:

a distinct brand that has a cult-like following

its own labeled products

quality ingredients

customer experience

leveraging technology

Wawa is a story about seeing opportunities before others, experimenting rapidly, and making ruthless business decisions along the way. Everything Wawa does is balance meticulous convenience while maintaining a neighborhood feel that makes you want to come back.

We caught Wawa mid-flight. This 200-year-old company is embarking on an unprecedented expansion. From taking years to leave the confines of the tri-state, it now aims to double store count by 2030 in its 'most aggressive growth' plan ever. This blitz scaling comes with hard questions about Wawa’s future.

We are going to bite down on five key decisions Wawa made that led us to this point:

Constantly Meeting Customers Where They Are

Slowing Down Convenience into an Experience

Embracing the Right Technology

Using Employee Loyalty to Stay Private (my personal favorite)

Product Expansion to Stay Hungry

Grab some wah-wah because this piece will leave you parched. And probably famished.

#1: Constantly Meeting Customers Where They Are

One thing about Wawa is that it's highly adaptable. Throughout its long history, it has done what it needed to get in front of customers. Starting from when it became Uber Eats for milk.

Uber Eats for Milk

George Wood, Wawa’s father hen was about that C.R.E.A.M. In 1890, pasteurization didn’t exist so kids were getting sick from drinking milk. Where others saw this as a reason to stay away from the milk business, Wood got into the thick of it.

He bought 1000 acres of land in Wawa, PA, and some British cows that, at the time, were like the Rolls Royce of cows. This ensured he had the highest quality cows in town. On top of that, he convinced doctors to certify that Wawa milk was more sanitary than others. Nothing like some regulatory capture! Perceived quality and safety drove a tremendous desire for Wood’s milk. This dovetailed with the growing milk delivery industry. He got what his customers needed and made sure it was in front of them.

C-Stores

Wawa crushed it as Uber Eats for Milk for like 50 years until consumers started to get up and get milk from “supermarkets”. George’s son Grahame saw how consumers were changing. He wasn’t about to let his cow be tipped. He went to Ohio, studied how these new “convenience stores” ran, and came back with a new vision for Wawa.

The first Wawa Food Market was opened in April 1964. It was stocked with Wawa dairy products and whatever equivalent of 1960s 5ive gum, Monster energy and beef jerky there was at the time. It was open earlier and later than those cursed “supermarkets”. Like his father, Grahame ensured Wawa’s products were where his customers were.

Gas Stations

In the 1980s, gas was catching fire around the country. Pay-at-the-pump machines with state-of-the-art credit card reading technology were beginning to take hold. By 1994, only 13% of convenience stores adopted to the times. Wawa made sure to be one of them. Actually, it was a Super Wawa. Think bigger stores, bigger parking lots, public bathrooms, and gas pumps. This once again reimagined the burgeoning convenience store franchise into a major player throughout suburban sprawl and along highways. The Wawa logo was expanding out to where its customers were going.

Geographic Expansion

In 2012, Wawa pushed out of its comfort zone again. They skipped a ton of States along the Atlantic and jumped right into the Florida swamp. This was exceptionally brave because Wawa’s success up to that point was largely due to supply chain optimizations that relied on their stores being clustered together. With a move to Florida, they would have to start over. This did not deter them. Wawa saw that Florida residents were already used to convenience stores and had cheap real estate. Perhaps more importantly, from there, it could use Florida as a beachhead for its future southern expansion.

Market Expansion

After a hundred years of dominating suburbs, Wawa wanted to test city centers. The kicker? They wanted to build their first city store in 85 days, in time for the Pope’s trip to Philadelphia. Not only did it get made, both sales and volume at this location ran 50% higher than estimated, proving that it made the right call. Wawa wasn’t content competing against Sunocos on the interstate. It wanted to go after the 7/11s and CVSs that dominated metropolises.

Fast forward to today, Wawa passed 1000 locations in April 2023. It is highly concentrated in the key East Coast markets but as we will discuss later, it wants to cross the Ohio River.

In hindsight, Wawa’s choices seem obvious – “Of course, you have to go to where the customers are!” But many other c-stores in Wawa’s position were complacent and didn’t take these leaps. Wawa did whatever it took to stay relevant, including changing its entire business model. That includes breaking the norms of what it means to be “convenient”.

#2: Slowing Down Convenience into an Experience

Convenience stores offer the bare, quick essentials and collect a few cents off each purchase. Their highest margin items are usually “smokes and cokes” (shout out Atul). As it did in 1890 and 1964, Wawa wanted to be different. It wanted to increase each customer’s average order value. And to do so, it would need to slow customers down a notch.

As the church provides its congregants bread, Wawa needed its own. Soft, filling, saucy… the Almighty Hoagie. This is not just a sub sandwich. This is a made-to-order, fully customizable sandwich experience that uses incredibly fresh ingredients. Don’t believe me? Wawa was voted AMERICA’S FAVORITE SANDWICH SHOP in 2018. Over Firehouse Subs, Jersey Mike’s, Jimmy John’s, Panera, and Subway.

These sandwiches were an attraction on their own. It gave customers a reason to seek out Wawa over its competition. Another byproduct of selling sandwiches is that customers need to kill time while they wait for them. They wander the aisles. They might get a Dr. Pepper Cherry (with a kiss of cherry flavor - it's amazingly smooth). They see the milkshake with the “extra thick” option and the wheels start turning. By forcing customers to slow down, they had more time to add to their carts.

Wawa didn’t just slow customers down with sandwiches. There were other ways to get people to choose them AND stay for longer:

having the cleanest bathrooms, as voted on by GasBuddy

surcharge-free ATMs nationwide

made-to-order Starbucks-like drinks

friendly store associates

fun oldies blasting from the speakers

Wawa has this magnetism. You can’t escape it. There is a reason to go there at any time of day. Wawa slowed down the c-store experience just enough until it became a beloved third place for suburbs all over the East Coast.

As Gandhi once said, if it doesn’t make dollars, it doesn’t make sense. All this work brought in $15B in revenue in 2022 – profitably. In 2018, Wawa stated its average order value (AOV) is $7.42/visit, a whole $3.30 more than the $4.12 industry average. This ability to expand AOV is Wawa’s edge over its bigger, broader competitors like 7/11 and Sunoco. It remains Wawa’s superpower.

Although I am repeating the words “slowing down”, by no means is Wawa slow. It leverages technology to speed up where it needs to.

#3: Embracing the Right Technology

I’ll say it. Wawa was the most innovative technology company of the early 2000s. Wawa introduced touchscreen ordering a whole five years before the iPhone. McDonald's didn’t even begin touchscreen ordering until 2015.

Beyond a cool factor, this one install:

sped up order volume

increased order accuracy

Increased AOV through on-screen upsells

reduced labor cost because there was no longer a need for there to be one person to take an order and another to fulfill it

As we saw with its inclusion of “pay at the pump” gas stations, Wawa once again chose the precise right technology for their business with touch screen ordering. It continues to find more. It has a compelling rewards app that lets you order ahead, it installed Telsa Superchargers and inked partnerships with delivery apps Uber Eats and Postmates to spread the hoagie gospel further into people’s homes. Wawa has a knack for leveraging technology where it needs to while keeping it human in other places like checkout and cleanliness.

#4: Using Employee Loyalty to Stay Private (my personal favorite)

I just love juicy corporate infighting. Never before have I read one like this.

As we’ve talked about in Blank Street, well-compensated employees are a strategic lever. They work harder, longer, and are more present. A unique Wawa perk is its Employee Stock Ownership Plan (ESOP). Introduced in 1992, this plan grants employees with at least 1000 hours of work shares in the company.

As of 2022, 40% of Wawa stock is locked into the ESOP. Yes, that means the employees own 40% of Wawa. A single Wawa stock was recently valued at $14,000, a mouth-watering increase of 1,455% from its $900 valuation in 2009. That’s a lot of hoagies. What’s important for this next part is that there is no secondary market for Wawa stock. The only way to “cash out” is by selling them back to the mother bird.

Let me introduce you to Dick Wood. Or as I like to call him, the Logan Roy of C-stores. He was the last Wawa CEO to be from the founding family. He shepherded the conglomerate into the behemoth it is now. Friendly guy. Ruthless tactician.

In the 1990s, Wawa erupted into civil war. Ownership was split between two warring family trusts. A boardroom brawl ensued when one trust sold a block of shares to the McNeil family – heirs to Tylenol. After Wawa experienced a period of immense success, the McNeils wanted to cash out. The other faction, Dick Wood’s faction, couldn’t afford to buy them out. So, the McNeil faction wanted to IPO their shares, a public offering.

This public sale would dilute Wood's family control and suddenly subject Wawa to the restrictions of a public company. Invoking the spirit of his ancestor Grahame Wood, Dick would not be cow tipped by the McNeils. He had to buy their shares. But how? They didn’t have the funds.

In a checkmate-level move, Dick turned to the very ESOP he started years prior. He convinced veteran Wawa employees to convert their 401K plans into ESOP holdings. This simultaneously took away ownership from other parties but also ballooned the cash sitting inside the ESOP. He then persuaded his employees to let him borrow the cash in the ESOP. With this move, he had enough to buy McNeil’s stake for $142M. He shut that shit down. Now bringing in $15B a year, his bet seems to have paid off.

When asked why staying private was so important, Dick said in an interview with Inc., "I don't think we could have driven the company to the size it is, with the culture it has, without being a private company. You're making short-term decisions, and we are focused on long-term decisions."

Keeping Wawa private gave it the room to experiment relentlessly. And the grandest experiments are happening now.

#5: Product Expansion to Stay Hungry

We caught Wawa at an incredible time. I would say it’s at a “crossroads”, but it’s already on the I-80. After successfully launching 200 stores in Florida, they are looking to move further West into Georgia, Kentucky, Indiana, and Ohio.

It’s not just that Wawa is expanding outward, it is the ambition of it. It took Wawa 60 years to get to 1000 stores. It plans to double that in the next seven. The U.S. convenience store industry is a $550 billion meatball sub and Wawa wants its bite.

In the classic Wawa way, they refuse to achieve this by replicating what they did before. Over the years, Wawa customers have seen many food concepts, store layouts, and locations. Lately, they are noticing an uptick in the sheer volume of these experiments. Boba popping up at certain stores. Pizza at others. Kombucha in a few. Different sized stores. Food-only stores with no shelves at all. That’s because of current Wawa CEO, Chris Gheysens.

As Wawa engages in combat with convenience giants across the country, it simultaneously is going after the $55 billion fast-casual market. It all but declared war on Sweetgreen, Starbucks, and Chipotle. This can be seen in its rapid-fire introduction of kale salads, small-batch coffee, and more Mexican food.

This is Gheysens’ stated "barbell" strategy. He wants to balance Wawa’s core competencies of cheap food, snacks, and gas with attracting new, more premium customers. This is doubling down on Wawa’s special ability to increase customers’ AOV over their competitors.

However, these experiments have received due criticism. Mixing hyper-growth while also tweaking the brand could certainly dilute what made Wawa “America’s Favorite Convenience Store”. Leadership recognizes that. In a conversation with Inc, Chris Gheysens says,

“You think of an In-N-Out Burger, they are very slow growth, very deliberate — [there is] cult status that’s attached to that. As you get bigger, the focus has to turn more toward efficiency, away from the tailored approach to business and more to the process approach of business. I just wonder how much that can possibly erode the cult relationship you have.”

Wawa is not merely growing into adjacencies. Gheysens is laying the groundwork for the next wave of consumer behavior: electric charging. It inked a partnership with Tesla for its coveted Superchargers back in 2017.

Although Superchargers are the fastest charging stations around, they still force convenience store customers to slow down. Wawa trips along highways will be going from 10 minutes to a minimum of 30 minutes. This is right where Wawa wants to be. By extending its product selection beyond sandwiches to whatever the customer needs at that time, it makes Wawa all that more tantalizing. It’s wrapping up an entire rest stop, that may traditionally consist of a Pizza Hut, Starbucks, Chopt, into one store. More time at Wawa means more money in its wings.

While others may see all this action as Gheysens running in different directions, I see it as a continuation of the Wood spirit that transformed Wawa from a dairy farm into a $15B sandwich-making, gasoline-spilling, coffee-sipping giant.

Wawa didn’t earn its wings by taking short-sized swings. It won’t start taking those now.

Woo! That was a doozy of a piece to write. Thank you for reading.

What’s next?

Like what you read? Please like and leave a comment. It really helps!

Consider sharing this with someone that loves Wawa or should love Wawa

If you’re a company that is interested in a deep dive, drop me an email.

Sources

The Inside Story of Wawa, the Beloved $10 Billion Convenience Store Chain Taking Over the East Coast

Wawa aims to double store count by 2030 as part of its 'most aggressive growth' plan ever

How Wawa makes money: $10 billion in sales and other fun facts

Wawa plans to double the number of its Tesla supercharging stations

That photo at the bottom wraps it up so neatly 🎀

Last month, I went to a Buc-ees for the first time so I think I can feel what the gas statin hype at Wawa's is about.