Welcome to the 23 who entered The Physicality since the last edition! Join the 670 of those who are into learning about the real world here:

I am 29 years old and living in the most exciting city in America. Yet, the most fun I’ve had in the last year was a night at Dave & Buster's. Not hyperbole or exaggeration. I was tremendously present. The only time I looked at my phone was to purchase more swipes. The competition that came from Mario Kart. The camaraderie that came from problem-solving. The adrenaline of fighting off hordes of zombies together. I was a kid again.

As I left, it dawned on me that we probably just collectively dropped more money playing games on a Tuesday – than we would have spent on a Saturday night out in Manhattan. This is the power of leisure. Hours can fly by without notice. And with those hours come the need for food, drink, and more. My crew’s exact consumer behavior. In a self-reflective spiral, I wanted to understand this new age of leisure and recreation.

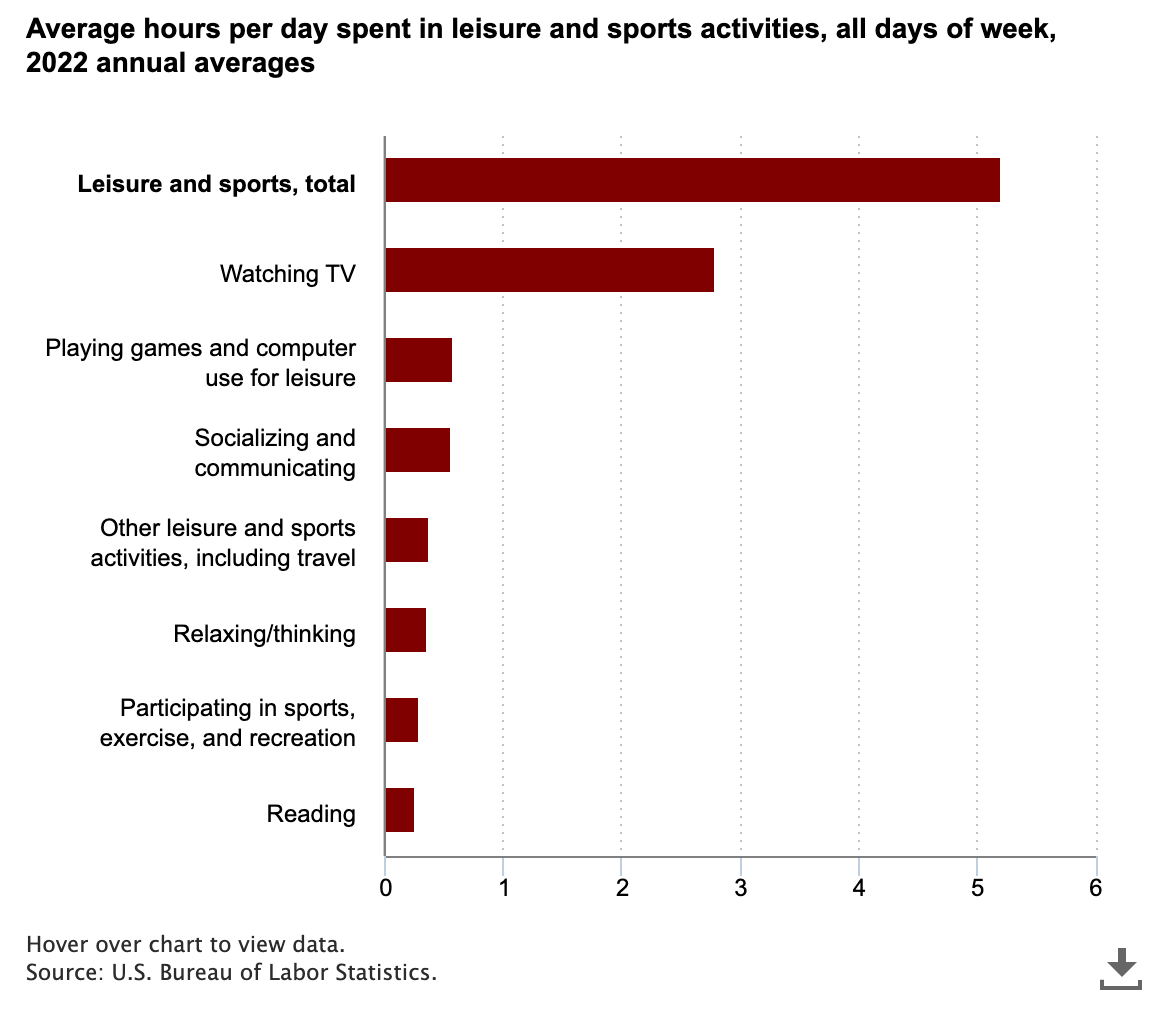

Americans spend more than five hours a day on leisure. Granted, that’s mostly spent on TV right now. Yet, I have a sneaking suspicion that we are entering a recreational renaissance that will pull more people from their couches into the real world. In particular, three new types of recreation models are taking up more square footage these days: “eatertainment”, new sports, and autonomous. I wanted to better understand all three.

Let’s Play:

Bowling Alleys and Family Friendly “Eatertainment”

Adult Eatertainment Explained

New Sports

Autonomous Recreation

Playtime is Over

Bowling Alleys and Family Friendly Eatertainment

Play has been a part of American life since before our founding. There are 17th-century depictions of Dutchmen bowling in “Bowling Green” park. Yes, the oldest park in Manhattan is named after the sport. This illustrates just how vital it was to the societal fabric of the time.

After being played in America for 200 years, the “American Bowling Congress” was formed in 1895 to set sport-wide standards. In New York City alone, there were hundreds of bowling alleys constructed to take advantage of the growing popularity. Bowling teams became local heroes. Anything becomes legit once beer companies spend advertising dollars on it. By the 1930s, the likes of Anheuser-Busch began sponsoring teams. These days, somewhere between 60-70 million Americans bowl at least once a year, making it the most common sport.

Yet in that tremendous growth, the nature of bowling alleys overall changed. In the 60s and 70s, alleys catered to the 9 million league and tournament players. It was a more serious, professional, adult-focused establishment. As league play shrunk considerably over the decades, bowling alleys changed their focus to families. They turned up the cosmic lights, added fun animations, and filled their food menu with children’s birthday party items. Bowling alleys became part restaurant, part activity. They were the forerunners of the “eatertainment” business model.

Of course, Chuck E. Cheese is considered the OG “eatertainment” company. Founded in 1971 by one of the Atari co-founders, Cheese is catered to families as well. For the kids, the draw is the games. For the business, they make their money off of the parents buying mountains of pizza and fountains of soda.

In the last few decades, a new generation of businesses are re-targeting “play” back to adults. Suckers like me.

Adult Eatertainment Explained

The draw for both the consumer and the owner of an eatertainment business is that it’s both a restaurant AND an experience. TopGolf is the TopDawg of this industry. At nearly $1.8B in revenue and 80 locations, they figured out the model: take something easy enough to learn, dress it up in a lounge setting, and slap on drinks. Some locations have over 100 golf bays and employ about 130 servers per shift. And we love it. Analytics firm Placer.ai has Topgolf traffic up 22% from 2019.

You can see this model used to create massive businesses out of things we did as kids. Bowling (Bowlero, $1B in revenue) and arcades (Dave & Busters, ~$2B in revenue) come to mind. All three companies went after already popular activities, built the largest venues possible and went for the volume play.

With the category legitimized by these corporations, we are seeing the niche-ification of the eatertainment sector. The next generation of eat-play-love chains are experimenting with lesser-known activities or testing out a different part of the market altogether.

Take “Swingers”, a fancy indoor mini-golf spot with city-specific food and cocktail menus. Its Manhattan location includes burger legend Emmy Squared. Founded in the United Kingdom in 2014, it still only has four locations (London, Manhattan, D.C.) with Las Vegas and Dubai on the way. In my conversation with Co-Founder Matt Grech-Smith, he asserts that Swingers is “the new wave of hospitality” where food and beverage remain core to the experience but a shared experience is the draw in. As opposed to a D&B, with mediocre food and drink options, he wants Swingers to be seen as “unexpectedly premium”.

Bar sales at Swingers make up 55% of a visitor’s spend while the activity is ~35% and food takes up the rest. Given that food is the smallest contributor to their operations, it makes sense that they establish location-specific partnerships to bring in brands that already have brand recognition in that market. Between the interior design to the F&B focus, it’s a unique take on the eatertainment wave.

Now, every activity imaginable – darts, cricket, surfing, F1 racing, curling – are being hospitality-ified. Heavy hitters from other industries are getting involved. Ron Shaich, the former CEO of Panera Bread has a $1B+ fund for concepts like these. EMERGING Fund from the founders of PuttShack and FB Society also invest here. I can see why.

The economics are compelling. Given that individual customers need less individualized attention and technology automates much of the experience, labor costs can be lower than in a similar-sized traditional restaurant. This makes a major difference when labor is typically a full third of a restaurant’s expenses.

In addition, the activity is often a high-margin line item. Robert Thompson, founder of pickleball eatertainment company Camp Pickle states in an interview with Restaurant Business that “the amusement side is 80% profit.” Again, this is vital when the average profit margin for a restaurant is 3-5%. The combination of lower labor costs with a high-margin revenue stream makes for a compelling business proposition.

Lastly, I imagine that people are spending more money on average at an eatertainment location than they would have on the activity alone. Think back on my time at Dave & Busters. Between the food, drinks, and swipes, it really racked up! Thompson says in a separate interview, “You can make 50% profit on $2 million with the activations, or 23% on $7.5 million. I’ll take the latter, and that’s what we get by leaning into the menu.” The food and beverage portion is paramount.

But eatertainment isn’t the only part of this recreational renaissance.

New Sports

With bowling going the way of eatertainment, pickleball is coming to take its place as the nation’s serious pastime. Now played by over 9 million people in the country, this form of recreation has a slightly different flavor. Yes, there are concepts like Camp Pickle and Chicken N Pickle that are taking that eatertainment approach to the sport already. Some call this subcategory “sportstainment”... not me though.

Others like Ace Pickleball Club just want to let the sport become a sport. Founded in 2020, they create professional, top-of-the-line indoor courts in big box retail spaces. Ace went with the franchise approach, establishing standards for things like ceiling height, climate control, court material, and the right courtside technology to use. Said technology is meant to improve the play experience. It can check whether a ball goes out of bounds and live stream gameplay.

Since offering franchise licenses in March 2023, they have already sold 100 locations across the U.S. The first two locations can be found in Fort Wayne, Indiana, and Roswell, Georgia. Ace distinguishes itself by focusing on the core pickleball experience, not much else. Chief Growth Officer Diego Pacheco says in an interview with CSA that, “We have no plans for food and beverage programs. Our core business is the pickleball experience.” Hardcore. Instead, Ace wants to service the tournament and league market that is emerging for the sport.

What Ace is doing for Pickleball is part of the same wave that explains the rise of sleek rock climbing gyms, spin studios, and boxing cardio locations. It is lowering the barrier to entry of previously lesser-known sports. It’s a different model of recreation and leisure for a different audience.

Autonomous Recreation

Self-mobile check-in. No on-site staff. Cameras monitoring from above. Communication is done through iPads and TV screens. This is the crux of “autonomous” recreation. In New York City, two concepts owned by PodPlay technologies have led the way: PingPod, a small format table tennis spot, and Sharks Pool Hall, which is the same for billiards. I got to speak with Co-Founder David Silberman all about it.

Autonomous gives up that “personal touch”. But in its place is a more natural feeling of playing in your rich friend’s basement. Surprsingly, it all works pretty seamlessly. You book a time on your phone. Your phone unlocks the door at that time. You go to the assigned room to play. When the next group comes, you head out. It’s all quite civilized. Just like Turo did with cars and Airbnb did with houses, PodPlay is allowing us to share pool and ping pong tables.

With 24 PingPod locations and a handful of Sharks Pool Halls with minimal issues, PodPlay has proven that autonomous retail works. Now, they’re licensing out their technology, called PodPlay, to others. The amount of autonomy used is on a spectrum. A pickleball client of theirs uses the autonomous feature in the hours before and after their employees are on site. Others are lowering headcount by monitoring most of the facility remotely.

I often question why even with the demand for experiences, my options for activities remain limited and relatively subpar in NYC. I’ve experienced better bowling alleys, pool halls, paintball arenas, and arcades in Bumble, PA than in the most dense city in the country. David posits that it comes down to economics. NYC has uniquely high retail rents and labor costs. This encourages a retail space to be a restaurant-turned-club over a gaming or karaoke lounge. David believes that autonomy can change the economic profile enough to make a wider variety of activity-based businesses viable. I hope so too.

Playtime is Over

So, why is this all happening now? It’s the coalescing of a few things and I doubt I captured all of it.

Alternative Experiences: Alcohol use is down in the younger generations. We also think it is more bad for your health than our ancestors. In its place, we are looking for other things to do. Yes, this could also be seen as a net negative for a generation of companies that hope to make their nut off of food & beverage but regardless think it is a net positive for the trend as a whole. We are looking for something else to do.

Nightlife is changing: Related to the above, clubs/bars as a percentage of nightlife spend is going down. Close to 400 clubs, 30% of all clubs, have closed in the UK since March 2020 with 83% of surviving venues saying they are on the “knife’s edge” of closing. In its place, new ways to spend our weekend nights are ready for more customers.

Free Real Estate: Big box retailers like Bed Bath and Beyond, Sears, and Macy’s going under or shrinking down. This makes room for new types of spaces that need much of it.

Pandemic: These new hospitality-meets-play concepts were already coming way before COVID-19. Swingers was founded in 2014. SPiN in 2009. Heck, D&B was born in 1984. But pandemic-induced demand for in-person experiences made these businesses more viable. Dollars that would have gone to casual dining are getting reallocated here.

Regardless of the reasons, I’m glad to see play going the way of hospitality. Of course, a going concern is that all forms of recreation eventually tap out. That they are all inherently fads. Even bowling seems to be on the decline. But that took hundreds of years. Sure, I can see many of these concepts never reaching scale and others dying out completely. But the ones that remain could be the ones studied by a small newsletter 50 years from now.

Play is a part of our life. And it needs to be a bigger part of our life. It’s as much a part of our species as anything else. Every culture, in every corner, in any part of history found ways to entertain themselves. That need to play together will outlast an economic downturn, any pandemic, and any fad. I hope that play becomes as integral to our society as bowling was to our predecessors. With more play, I think we can, as Derek Thompson says, “imbue residents with a vibrant social metabolism – a verve for getting out and hanging out.”

If you want to play more, consider signing up for Joust. There is a fancy game night tonight at 7pm in Williamsburg, Brooklyn. I would love to have you. Don’t know what I’m talking about? Read all about “Soho House Meets Game Night” here.

Keep it real,

Safi

another interesting angle to decline of alcohol is seeing venues cater to other kinds of events like reading parties: https://www.instagram.com/reading_rhythms/?hl=en

also, I'm a big fan of Happy Medium (art cafe): https://www.instagram.com/gethappymedium/

the thoughts on leisure changing also makes me think of how dating will change. right now it still seems like Hinge -> drinks at a bar