Today’s Thesis Driven is a guest letter co-authored by Safi Aziz, founder of Joust, a play-first social club and Jordan Pascasio, investor at Sharp Alpha, a venture capital firm specializing in sports, gaming, and entertainment.

Play is a bedrock of community, and it’s increasingly playing an important role in the real estate industry. From sprawling suburban shopping malls to dense metropolises, dozens of play venues are expanding, snatching up retail spaces and raising fresh capital. Here are some recent high-profile financings, for example:

And that’s just a handful of headlines. Cushman & Wakefield reports that “competitive socializing” concepts in the US have grown a staggering 386% since tracking in 2021.

Today’s letter will explore the burgeoning play industry, which includes “eatertainment”, “competitive socialization”, “sportainment” and Safi’s own term “hospitaliplay” from multiple angles. We will cover:

the category’s watershed moments

consumer drivers that have pushed the play industry forward

how we taxonomize and categorize the entire sector

the financial viability and takeaways for real estate owners

the recently announced Topgolf spin-off contextualized against the key concepts herein

The Play by Play

Three key events charted the course of the 'play' industry seen today: Dave & Buster’s introducing adult play, Topgolf infusing technology, and the “Big Merger”.

D&B Introduces “Adult” Play

Most “eatertainment” narratives begin by celebrating Chuck E. Cheese as the first company to successfully scale within the category. Instead, we think Dave & Buster’s should receive the credit they deserve. “D&B” opened the first adult-focused eatertainment concept the same year as Chuck E. Cheese did theirs for kids, in 1982.

Founded by a blackjack dealer (Dave) and a former T.G.I.F. employee (Buster), the brand pioneered the adult play market. Their formula was simple: combine a menu like T.G.I.F.’s with parlor and arcade games. It was a winning proposition. The core product remains almost the same after nearly five decades of operations, 150+ locations, and $2.2B in annual revenue.

Earlier this year, the company announced a new location format that would include “Social Darts Bays” and “Social Shuffleboard Bays” – both games that have been popularized by Flight Club and Electric Shuffle, respectively. The entrance of a legacy giant like D&B into this vertical provides further validation of mounting momentum.

Topgolf Infuses Technology

Topgolf, founded out of the UK in 1997, changed the game when they combined new technology with old sport. They installed microchips inside golf balls to create a new driving range experience that was more social and gamified. The various game modes broadened its market size from “golf active” to “golf curious”. By infusing technology and adding food & beverage (F&B) to its offering, Topgolf fundamentally swung the sector's trajectory, setting new standards for experience-driven entertainment.

The company’s model inspired dozens of eatertainment concepts, each seeking to replicate the unique blend of entertainment, socialization, and F&B that propelled Topgolf's success. The period from 2007 to 2020 witnessed the emergence of numerous now-prominent brands, including Puttshack & Swingers (mini-golf), Electric Shuffle (shuffleboard), Pinstripes (bowling/bocce), Flight Club (darts), and plenty more. Beyond the core activity the business is based around, these companies differentiate themselves from Topgolf through the quality of their food and beverage program, interior design, use of technology, and level of socialization.

The “Big Merger”

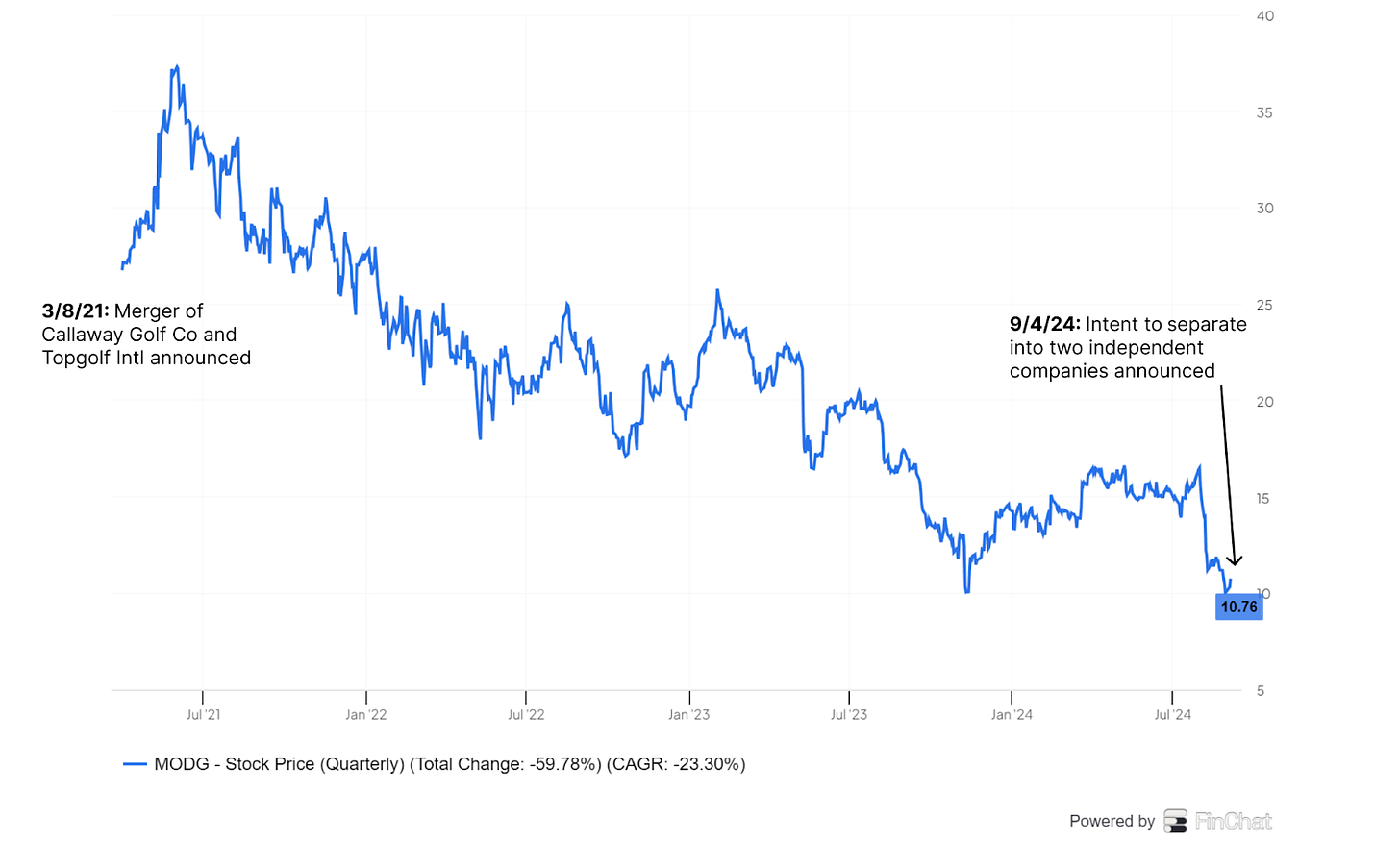

While the 2021 merger between golf equipment leader Callaway and Topgolf is under scrutiny today, the transaction pushed the burgeoning play industry forward. Callaway valued Topgolf at $2B, validating adult play as a scalable business model that could generate significant returns for investors. The exit transformed competitive socialization from a niche segment into a significant player within the broader "out-of-home entertainment" industry. A clear financial target was now on the scoreboard for Topgolf's peers to aim for.

Playtime is Over

The growth and prominence of this industry is driven by the coalescing of three consumer trends: desire for alternative socialization, demand for experiences, and social media.

Alternative Socialization

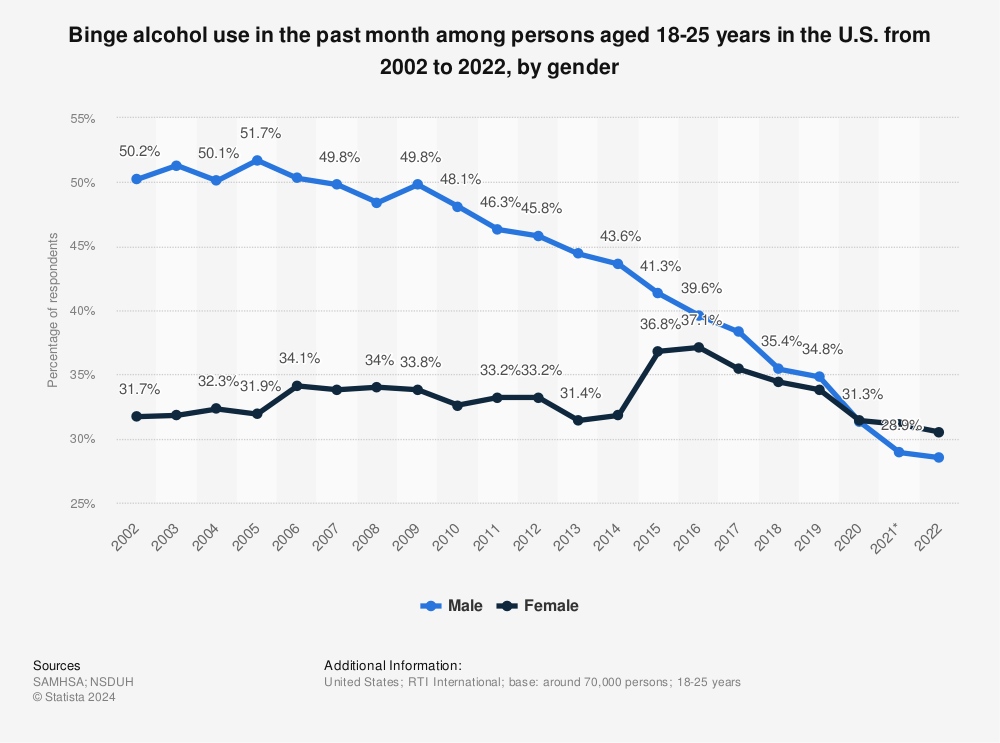

Alcohol is losing its vice grip, leaving an opening for alternative socialization. 61% of Gen Z and 49% of Millenials aspired to drink less in 2024. Americans overall now feel, more than ever before, that even casual drinking harms our health. Most notably, binge drinking has been on a downward trajectory.

These behavioral trends are also evident in the United Kingdom. Clubs and “late-night bars”, where binge drinking takes place, have lost 10% and 6% of sites in just the last 12 months. “Competitive socializing” was primed to take its place. These play venues were the single largest source of bar growth over the past year in the UK at a staggering ~29%.

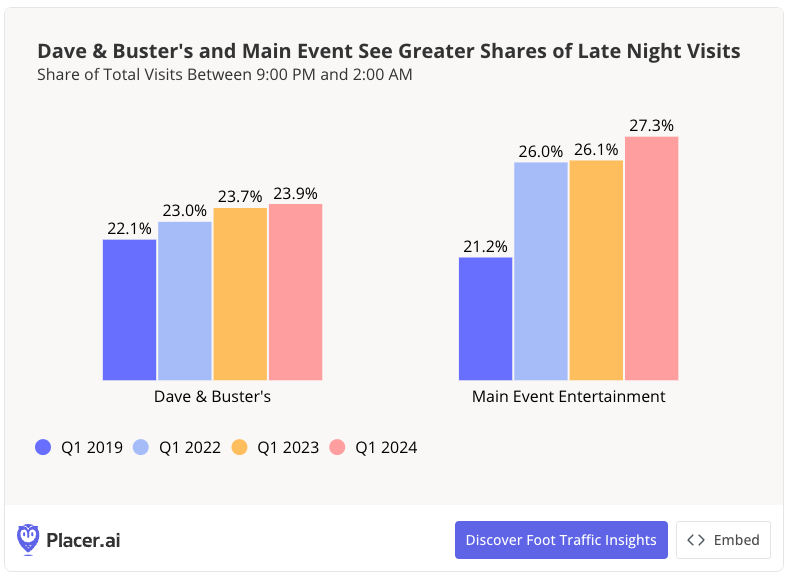

Stateside, Dave & Buster's, and its sister brand, Main Event, have seen increased traction with late-night audiences. Given their pole position in the market, D&B can be used as a proxy for broader consumer trends. Nightlife is becoming increasingly play-oriented.

Robust Demand for Experiences

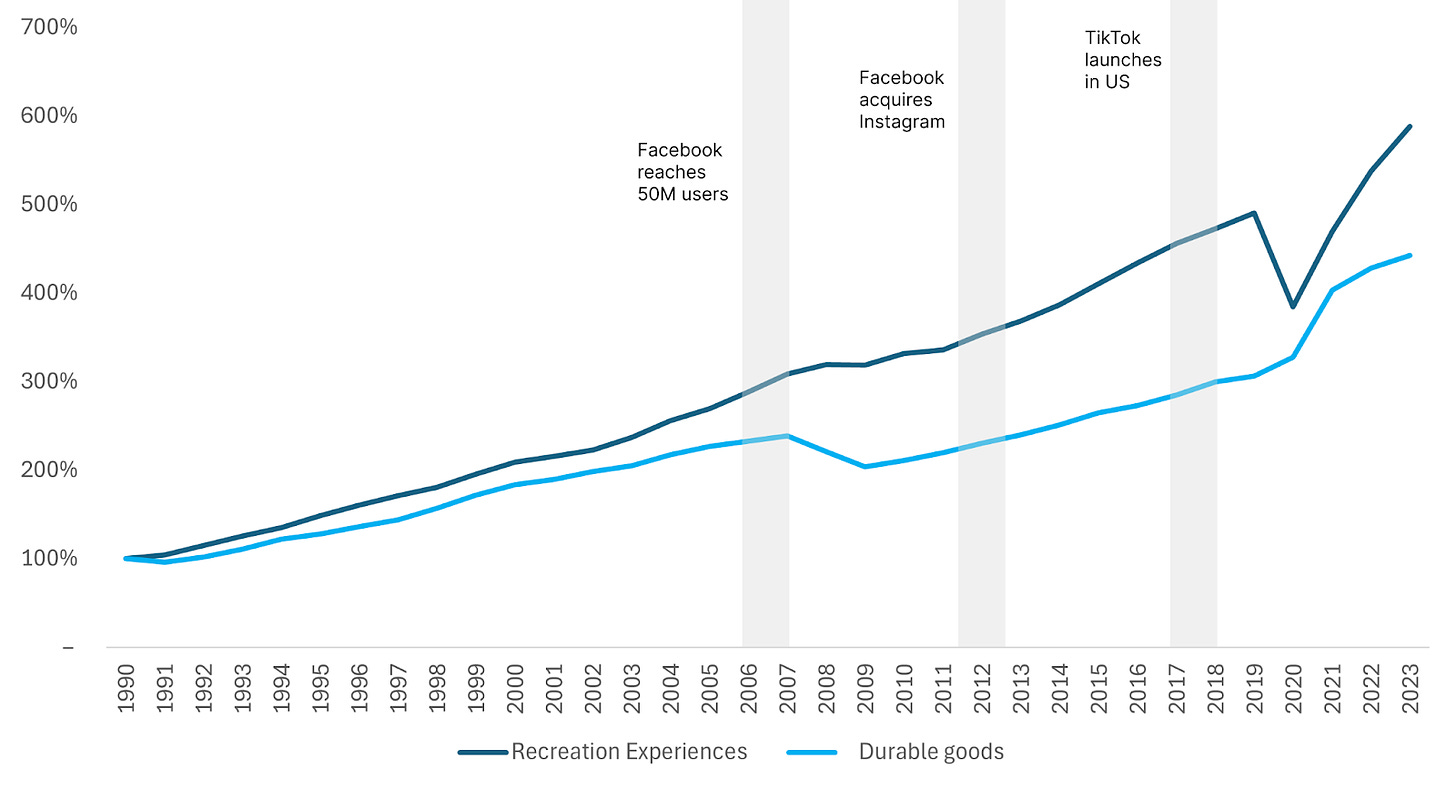

78% of Millennials would rather spend money on experiences versus buying material goods. Separately, 69% of Millennials stated that live experiences make them feel more connected to other people, the community, and the world. As a result, consumer demand for experiential shared leisure has increased significantly over the last decade and remains strong post-pandemic. Notably, the largest spending gains have been in amusement parks & arcades, spectator sports, and live entertainment.

Social media-induced FOMO

Millennial and Gen Z consumers spend 4+ hours daily on social media. Much of this is spent broadcasting their activities, often valuing the impression made on followers more than the experiences themselves. Play venues cater to this by offering unique, “Instagram-worthy” moments. This content serves as free advertising for the brand, pushing awareness of these concepts in a way other retailers don’t benefit from. We believe this is a major reason why “recreation experiences” began to heavily outpace durable goods spend in the social media age.

Taken together, these trends reveal that people want to do more Instagrammable things together, at night, other than binge drinking. This leaves a significant opportunity for competitive socialization venues (CSV) to grab increased share of wallet and mind.

Core Business Drivers

While competitive socializing concepts are abundant, two key distinguishing factors define what we believe to be the strongest models. Concepts that effectively align these factors are well-positioned for success, as they represent leading indicators of a durable business model, which ultimately translates into a strong financial profile.

High Visit Frequency

High F&B Spend

High Visit Frequency

Looking across the landscape, we observe that the most successful concepts generate frequent traffic from a broad audience, rather than relying on one-off, novelty-driven visits. Fundamentally, the top priority for any concept is driving customer footfall and fostering repeat visits, while optimizing F&B spend and increasing dwell time are critical but complementary drivers of monetization.

Take axe throwing, for example. It’s a lot of fun—the novelty is part of the draw, driving organic awareness on the back of virality and word-of-mouth advertising. Yet, most people are not likely to throw axes regularly. This results in challenging unit economics, particularly in markets with expensive retail footprints.

Topgolf has also underperformed in this area, aiming to increase average annual customer visits from 1.5 to 3-4. In contrast, UK venues centered on casual, social activities such as bowling, mini-golf, pool, and darts have demonstrated significantly higher engagement, with over 10 visits per customer annually.

It’s not just Visits per Customer that matter, but Visits per Capita. A venue in New York City with a single daily customer would perform well on the former metric but poorly on the latter. Activities with widespread appeal attract larger and more diverse cross-sections of the target market. This has been another challenge for Topgolf, which is much less accessible to non-golfers than, for example, Bowlero is to non-bowlers.

High F&B Spend

When it comes to F&B monetization, activity alignment is paramount. Concepts focused on more physically intensive activities like soccer, basketball, baseball, or pickleball are inherently less conducive to F&B consumption. The relatively higher exertion levels and the lack of historical association between these sports and F&B—where players typically don't pair activities like shooting hoops with consuming a craft cocktail and a burger— may limit their effectiveness in driving F&B revenue. As such, we assert that activities like pool and darts are best positioned due to their longstanding association with F&B consumption and extended dwell times.

And yet, while driving incremental F&B spend increases total revenue and unit volumes, it dilutes gross margins due to higher COGS (e.g., food, labor) compared to gameplay. For venues with a revenue mix skewed toward F&B, it is critical to protect margins by maintaining an upscale ambiance and menu that supports high-margin items like $25+ craft cocktails and, at the higher end, seafood towers and bottle service.

Ultimately, there is no one-size-fits-all approach. The balance between F&B and gameplay revenue is activity-specific and requires deliberate commitment, ensuring it aligns with the operator’s core concept to effectively define market positioning and drive long-term profitability.

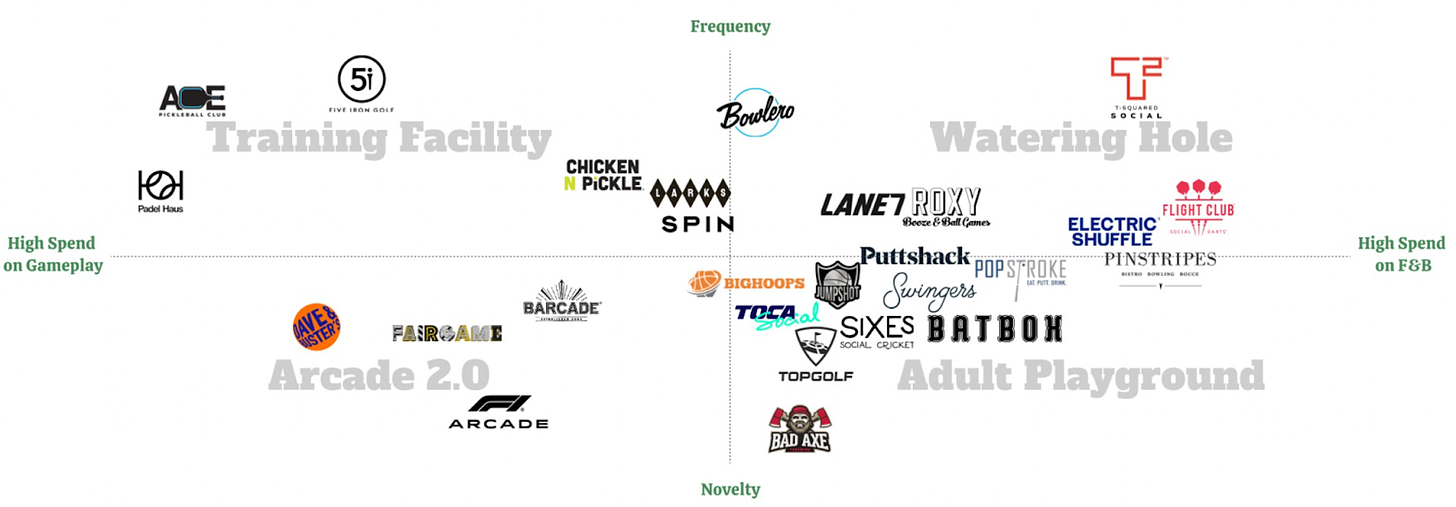

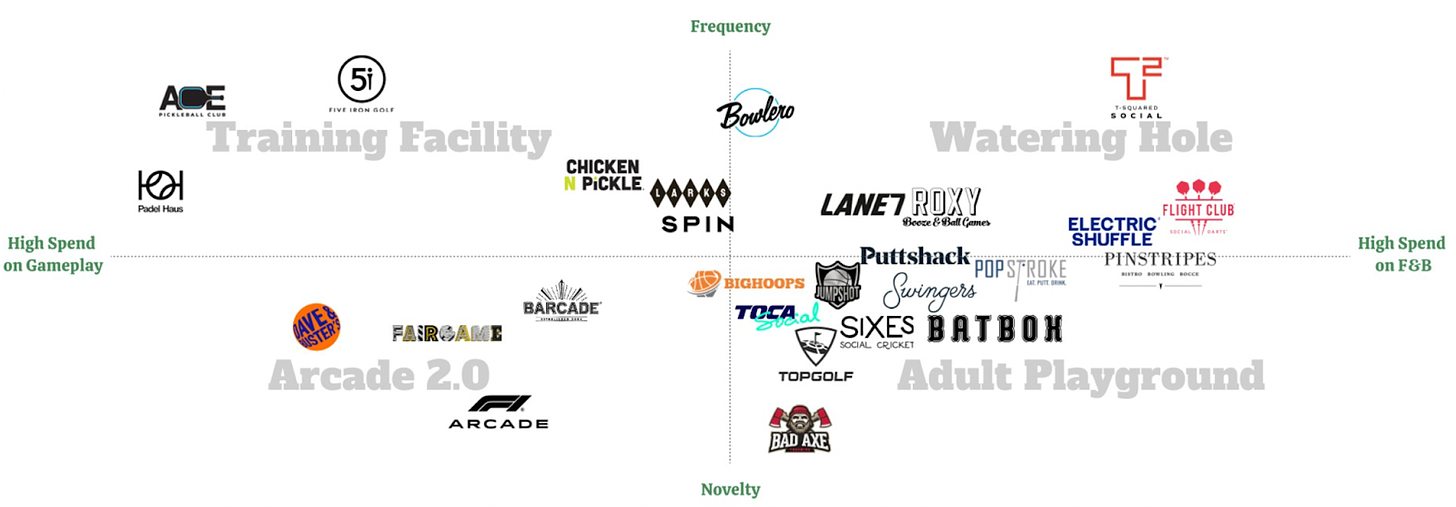

By merging the Frequency-Novelty and Gameplay-F&B spectra, we arrive at a rough map of the competitive landscape on these dimensions, with companies in the top-right quadrant well positioned for success.

Real Estate Angle & Financial Profile

Real estate has a critical part to play in whether or not this movement is fully realized. So, let’s look behind the walls at how the economics of the space have played out.

Location, Location, Location

As landlords repurpose vacant retail and hospitality spaces (e.g., nightclubs), competitive socializing venues are emerging as attractive anchor tenants, offering a compelling solution to fill this void. However, the success of these concepts is highly dependent on location selection, which is not one-size-fits-all. Novelty-driven venues like Topgolf or Dave & Buster’s can thrive as destination experiences, attracting diverse audiences—including families—without the need for high foot traffic. In contrast, more habitual, repeat-visit concepts such as darts, pool, or shuffleboard benefit from urban environments with high footfall. These venues fit seamlessly into the local social scene, leveraging proximity to trendy hotspots and the organic cross-pollination that comes with it.

Pinstripes offers an interesting case study in location selection with its strategy of securing prime real estate in high-traffic Class A malls, capitalizing on the growing number of big box vacancies. Its experience-driven model generates synergies with premium retail brands, enhancing the tenant mix and supporting the overall positioning of these upscale properties. This is underscored by Pinstripes’ 10 to 20-year leases with major REITs like Brookfield, Simon Property Group, and Westfield, as well as direct investments from these firms—signaling strong institutional confidence in the long-term viability of the concept.

However, most competitive socializing venues, including Pinstripes, operate under lease structures rather than owning assets, which can pressure profitability. While large REITs offer substantial tenant improvement (TI) packages, the high fixed costs associated with premium locations—such as real estate taxes and common area maintenance fees—can erode margins. Pinstripes’ dining-first, gameplay-second strategy further complicates profitability, as its reliance on F&B for ~80% of revenue increases exposure to volatile labor and food costs, leading to compressed site-level margins.

Pinstripes' growth and profitability challenges since its public listing at the beginning of the year prompt a critical question: can competitive socializing concepts succeed when retrofitted into legacy retail spaces? Or do site locations need to be developed from the ground up with experiential in mind? Successful examples, like Area 15 in Las Vegas and the rise of adjacent sports developments, highlight the opportunity for spaces designed entirely around entertainment, blending hospitality and immersive experiences. These spaces require a complete rethinking of traditional retail center layouts, with a focus on flow, wayfinding, and integrating entertainment elements from day one.

Compelling Financial Profile

While diversifying the tenant mix, enhancing brand identity, and increasing foot traffic are clear benefits that competitive socializing concepts offer, landlords ultimately prioritize one key concern: the sustainability of rent. When executed properly, these venues deliver scale and strong site-level economics, addressing this concern and providing landlords with confidence in long-term rent viability.

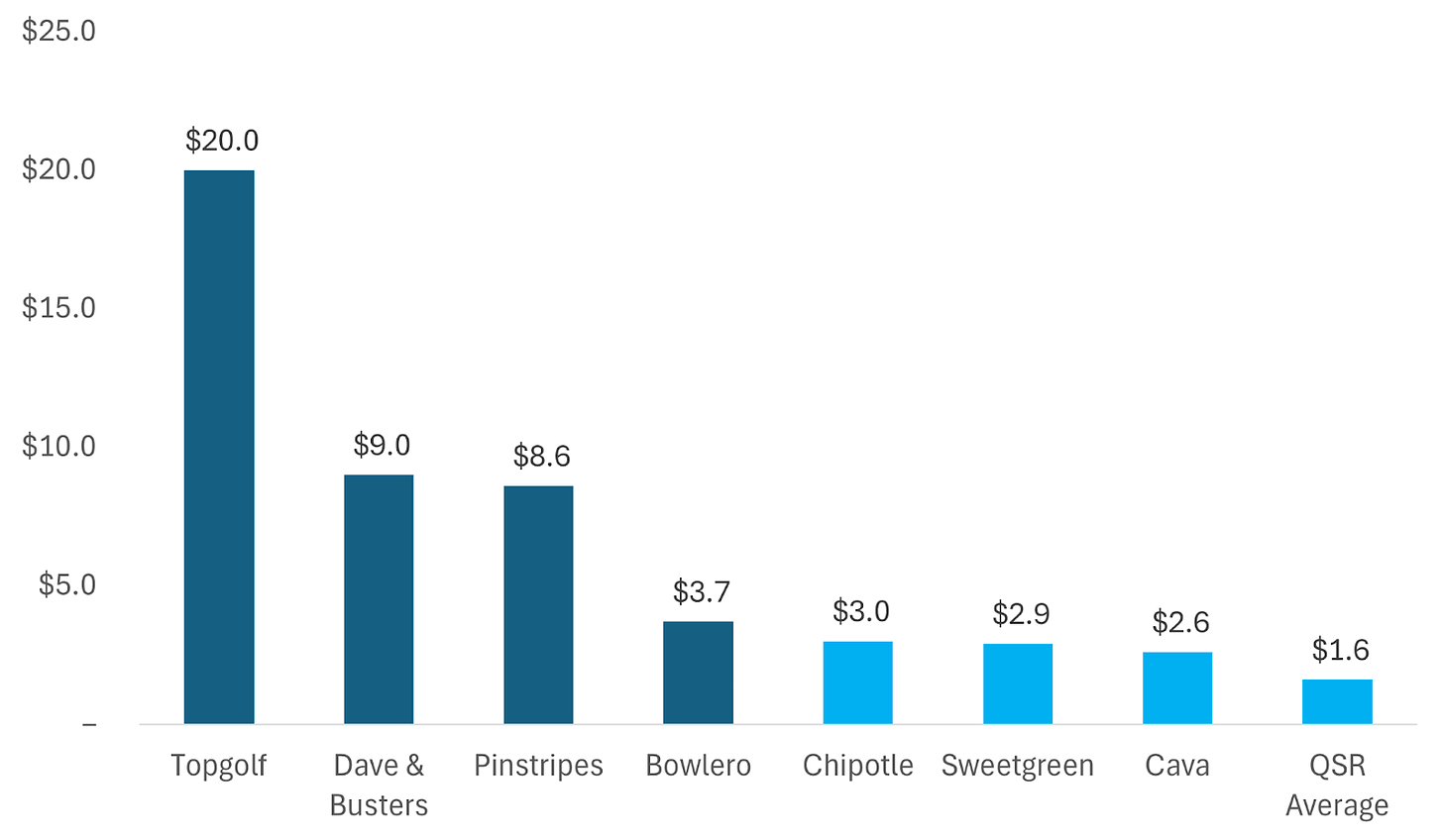

The unique combination of F&B and gaming across a larger retail footprint drives higher unit volumes ($10M+) compared to QSR or fast casual concepts ($1-3M), reducing the reliance on rapid location expansion to scale. In other words, competitive socialization concepts can achieve $50M in sales with just four to five locations, highlighting the segment’s strong revenue potential.

Additionally, while successful restaurants typically achieve 10-15% site-level EBITDA margins, venues offering competitive socializing can see figures above 25%, driven by high-margin gameplay and premium F&B offerings.

These healthy EBITDA Margins translate into higher ROICs relative to out-of-home entertainment peers with comparable retail footprints, meaning shorter payback periods.

Nonetheless, pursuing an owned and operated competitive socialization concept is not without its challenges, as it requires careful navigation of several risk factors. These include intense competition within the segment, geographic and expansion-related risks, potential construction delays, exposure to cyclical pressures from lease obligations, fluctuating food and energy costs, rising labor expenses, and shifts in consumer preferences.

To mitigate these risks, competitive socializing operators must strategically leverage both operational and growth measures. On the operational side, a disciplined site rollout strategy is critical for sustainable growth, ensuring an optimal balance between expansion cadence and footprint efficiency. Failure to align space requirements with market demand can leave a concept vulnerable to even minor shifts in consumer behavior, leading to financial strain.

On the growth front, operators can implement diversification strategies to enhance core revenue streams, such as events, while unlocking high-margin ancillary opportunities through franchising and licensing proprietary technology to third parties.

Establishing a dedicated events sales team to target major corporate clients—who typically deliver higher F&B and gameplay spend—serves as a strategic pillar, with the potential to drive 30+% of a concept’s total revenue. Additionally, corporate events often occur during off-peak periods, such as weekdays, effectively optimizing utilization.

Third-party licensing presents a differentiated, high-margin revenue opportunity, offering significant upside for concepts capable of supporting and scaling this model early on. Historically, Topgolf’s highest-margin (~75%) business line was TopTracer, a white-label solution for driving ranges that want to offer customers shot tracking, analytics, mini-games, etc. Despite pioneering tech-enhanced driving ranges as a social destination, sources suggest Topgolf missed a key early opportunity by delaying the strategic development of its tech licensing potential, weakening its first-mover advantage in this high-margin revenue stream.

Notably, Callaway retained TopTracer in the entity separation (more on this breakup in a second), highlighting Topgolf’s failure to effectively monetize and leverage the asset. Nevertheless, this decision underscores TopTracer's significant untapped potential and its strategic alignment with Callaway's core focus on the “golf active” market, where synergies are more naturally realized.

Topgolf’s Spin-off

Earlier on, we celebrated the Topgolf Callaway merger as a watershed event for the play industry at large. At a company level, however, it was a different story. Management expected they could convert Topgolf visitors into golfers and, therefore, into Callaway equipment customers. Almost instantly, the market punished Topgolf Callaway for it and continued to disbelieve the narrative in the following years.

So, it’s little surprise that Topgolf Callaway recently announced its intention to pursue the separation of its business into two independent companies in late 2025, just four years after the merger. The stated reason for the separation is that, “Topgolf has a different operating model, capital structure and investment thesis than Callaway.”

The expected synergies didn’t pan out. Beyond the fact that Callaway and Topgolf share a connection to "golf," their business models are fundamentally different. Topgolf is an entertainment business catered to the "golf-curious" consumer. Callaway, on the other hand, targets the "golf-active" market, serving core enthusiasts and performance-driven players. The vision of converting newly accessed Topgolf customers into Callaway ones never came to fruition.

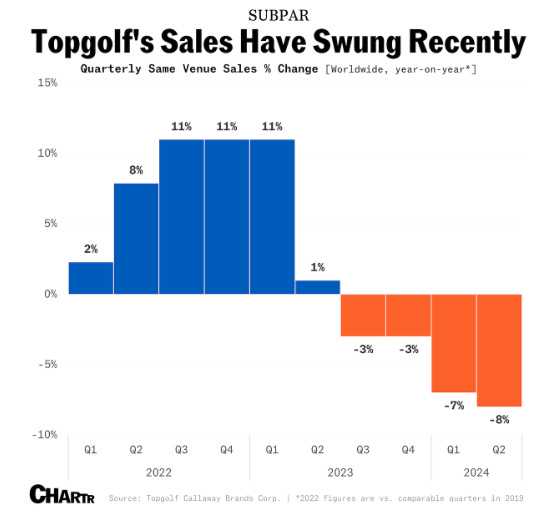

Topgolf’s product-market misalignment kept it reliant on novelty, with customers averaging only 1.5 visits per year, falling short of building habitual repeat traffic. As demand normalized post-COVID, management acknowledged that this misalignment hurt same-venue sales, highlighting the critical importance of visit frequency as the foundational driver of success in this segment.

To be clear, Topgolf’s spin-off is not a condemnation of the play industry at large. Callaway was just not the right steward of the brand. As a stand-alone company, Topgolf can focus on its strengths as an entertainment giant. We see a compelling opportunity for Topgolf to inspire stickiness across a broader swath of the golf spectrum by introducing more reasons to come back. They could roll out skill-based simulators with “bet on yourself” odds and payouts (e.g., "closest to the pin"), invest in par-3 courses, and focus on community through organized leagues. These innovations would not only deepen existing customer engagement, but also expand its market size. In turn, these modifications could further inspire an efficient real estate strategy where they can squeeze every drop of juice available in that respective market.

Looking Ahead

It’s clear that play as a form of socialization has taken hold. Yet, which forms of play consumers will gather for and spend on remains to be seen. The key question remains whether these concepts are merely transient fads or indicative of a lasting, structural shift in consumer behavior. While there is little doubt about the enduring demand for experiential shared leisure, same-store sales data offers valuable insight into current market sentiment. Although recent data points to a broader trend of decline, it's critical to contextualize these figures against the underlying core drivers of success (i.e., visit frequency, F&B spend/balance) which continue to shape performance and long-term viability.

Novelty-driven Topgolf and Dave & Buster’s have seen their same-store sales deteriorate, reflecting the competitive pressures in the out-of-home entertainment space. Pinstripes has trended in the same direction, albeit for different reasons. The company’s F&B-heavy model increases its exposure to cyclical risks and recent consumer belt-tightening impacting the broader hospitality and retail sectors. In contrast, Bowlero, which has posted three consecutive quarters of same-store sales growth (adjusting for weather-related impacts in Q1 ‘24), benefits from weekly or bi-weekly leagues and a historical association with frequent social gatherings.

The divergence in performance highlights the importance of cultivating repeat visitation for accessible, social experiences that go beyond novelty and appeal to a broad audience. By aligning gameplay with high-margin F&B options, operators can maximize both dwell time and spend per head. Ultimately, we believe the real winners will be those who combine these strengths with an efficient real estate strategy, optimizing returns while continuing to deliver memorable experiences that keep both the fun—and profits—rolling.

—Safi Aziz and Jordan Pascasio

Thank you to Gene Ball, President of Electric Shuffle, Jeremy Simmonds, co-CEO of the Institute of Competitive Socialisation, and Grant Kimmerling, CEO of Virsona for their input and direction.